By Beckie Menten, Building Decarbonization Coalition & Bruce Mast, Ardenna Energy

Destructive wildfires, deadly heat waves, drought, flooding, and a tropical storm this month: California is experiencing one extreme weather event after another. To keep Californians safe, we need to cut the pollution that is fueling the climate crisis and create climate-ready homes. Fortunately, equipping homes with clean, electric appliances like heat pumps can provide life-saving cooling and air filtration while cutting climate pollution. But six million of the state’s 14 million households – about 40% – lack access to capital for clean energy upgrades and weatherization. Though some grant programs pay 100 percent of the upgrade costs for low- and moderate-income (LMI) households, at the current rate of funding, it would take California more than 150 years to cover all of these homes. If California is going to upgrade millions of homes to be climate-ready, we need equitable financing to remove the cost barrier so that the state’s LMI households can electrify.

This month, the California Public Utilities Commission (CPUC) took an important step toward a new equitable financing program that can help millions of lower-income households access clean energy upgrades. On August 10, utility commissioners directed investor-owned utilities, including Pacific, Gas & Electric, Southern California Edison, and San Diego Gas & Electric, plus the Community Choice Aggregator Silicon Valley Clean Energy, to submit a joint proposal to pilot inclusive utility investment (IUI) financing, also known as tariffed on-bill financing (TOBF). In doing so, the CPUC directs the parties to start with the Silicon Valley Clean Energy proposal and incorporate U.S. Environmental Protection Agency guidance for IUI. The joint proposal is due by late spring of 2024 and if the CPUC approves the proposal and authorizes the pilots, the program could be scaled for the state.

Here’s how IUI financing works and why it benefits lower-income Californians and renters. IUI financing is groundbreaking because it works differently from a traditional bank loan and other on-bill financing programs, which are loans that are repaid on a customer’s utility bill. A traditional bank loan places responsibility on the borrower, which may require a certain credit score, home ownership status, income level, or employment for an applicant to qualify for the loan. Similarly, other on-bill financing programs place the onus of repayment on the customer. A bank loan also usually requires repayment within a few years at high-interest rates.

IUI financing is unique in that it shifts the investment responsibility from the customer to the utility. To recover a portion of the investment, the utility can place a tariff, or a cost recovery charge, on the customer’s utility bill, subject to the condition that the charge must be less than the customer’s expected bill savings. Because the utility’s investment does not impose any new financial burden on the customer, these programs do not require credit evaluation of an individual. This expands access to home upgrade opportunities for those who may have lower FICO scores or other credit issues, such as gaps in employment. The tariff is assigned to the meter, which means that repayment can be spread out over the life of the appliances–typically ten years or longer–thereby reducing the monthly charge and making the project more affordable.

Additionally, IUI financing can be a solution for renter populations. Since the obligation of repayment stays with the building, renters only repay the portion of the investment while they are occupants and benefiting from the technology. This can also address what is known as the “split incentive”–when a landlord is responsible for purchasing appliances, but does not pay utility bills–which offers little incentive for the landlord to spend more money for a more efficient appliance.

Because IUI programs can serve renters and low-income populations, it is critical that these programs are designed with rigorous customer protections. IUI programs should ensure that the tariff, or monthly charge, is less than the customer’s expected bill savings. This means that even with the tariff, the customer’s energy costs would either stay the same or be less than before they upgraded to clean, electric appliances. To achieve this, IUI programs should be designed so that the monthly repayment amount is no more than 80% of the expected energy savings. In other words, if a heat pump water heater is expected to save $50 a month on energy costs, the monthly charge should be set at no more than $40. This helps to ensure that the customer does not see a net increase in charges while protecting future occupants from overpaying when they assume occupancy.

Since IUI program charges are capped at no more than 80% of the energy savings, both the cost of financing and the upfront cost–or the money needed to retrofit the home–need to be as low as possible. This can be achieved in two ways. First, the program should leverage all available state and federal incentives to reduce the upfront investment. Secondly, the program needs to procure low-cost capital to keep interest rates down. To help with the latter, the California Legislature passed SB 1112, authored by Senator Becker, last year. SB 1112 directed the California Energy Commission to leverage state and federal funds to provide this low-cost capital and/or attract lower-cost private capital for IUI programs. It also established the necessary notification requirements to allow the charge to transfer with the building occupancy.

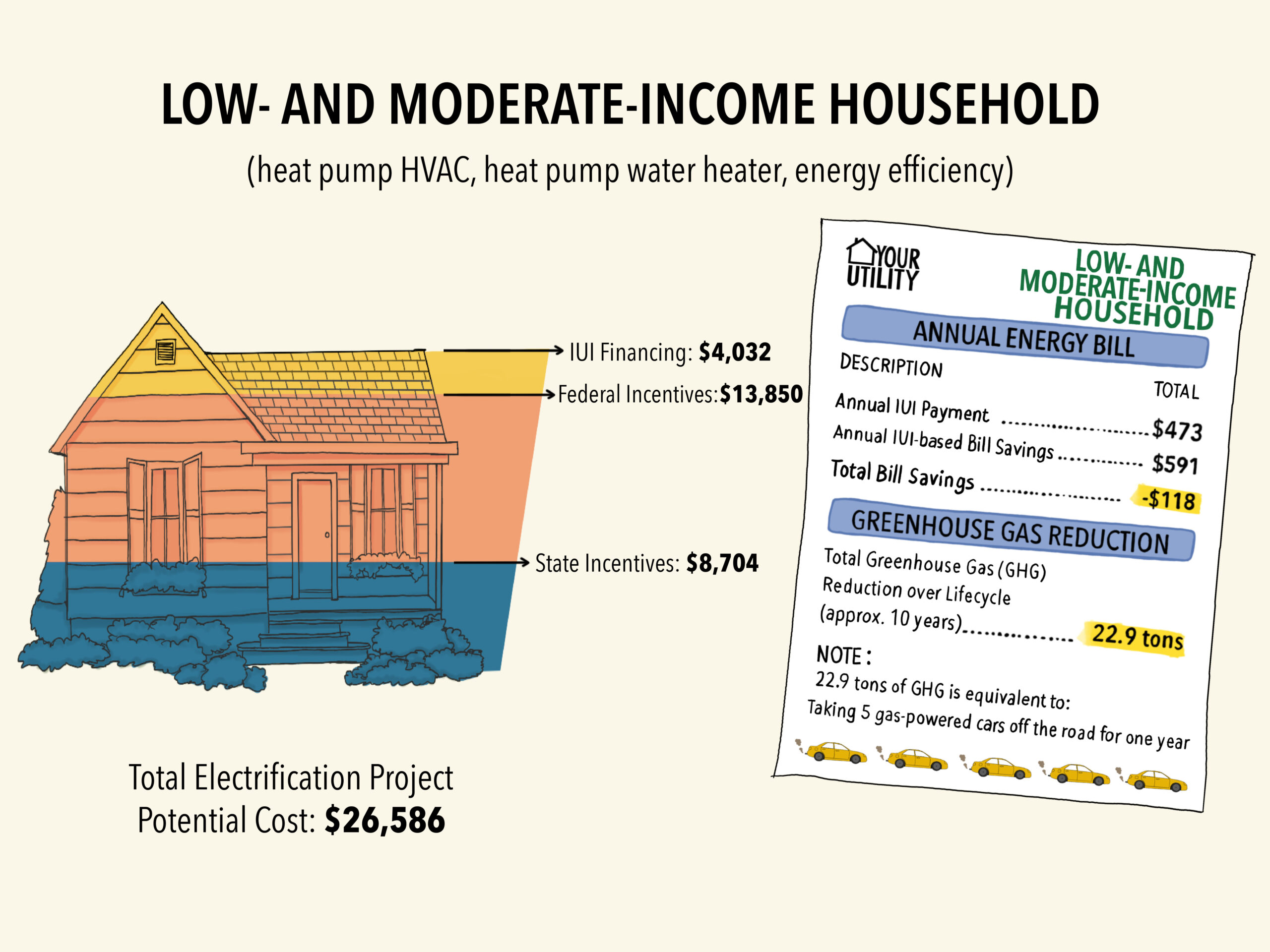

Here’s how IUI financing would work for a potential electrification project with a cost of $26,586 for upgrading gas space heating and water heating to an electric heat pump and heat pump water heater (HPWH), plus associated weatherization upgrades. The illustration below highlights how state and federal incentives and utility investments can be stacked to offset the cost of electrification for LMI and market-rate (upper-income) households.

Caption: Annual energy bill calculated with weighted average by climate zone. CARE discount applied in calculating electric charges.

For LMI households, state grants and programs could provide $8,704, the Inflation Reduction Act (IRA) could provide up to $13,850 in incentives, and the IUI financing could cover the remaining $4,032, amounting to an annual charge of $473. Since the annual charge is capped at 80% of estimated bill savings, the energy savings from the upgrades would offset the monthly charges to the customer, providing an additional benefit of reduced monthly energy bills. The total greenhouse gas reduction over the lifecycle of the clean energy upgrades would total about 22.9 tons, or the equivalent of taking five gas-powered vehicles off the road for a year.

Caption: Annual energy bill calculated with weighted average by climate zone.

For market-rate households, state incentive programs would cover $4,100 and the IRA incentives would cover $3,200. (IRA tax credits of up to $3,200 could also be claimed though this is not included in this example as the credit may vary.) Because the monthly charge is constrained by available utility bill savings as part of the IUI program design, the financing would be limited to cover an additional $4,551. The customer would have a net copay of $14,735, which is less than the like-for-like replacement cost for a gas furnace and water heater, and air conditioner.

As the climate crisis exacerbates extreme weather in California–there has never been a better time to upgrade with clean, electric appliances for clean cooling, air filtration, energy efficiency, and bill savings. IUI financing is an equity-minded approach that prioritizes LMI communities for electrification so that they can create safe, healthy, and climate-ready homes. The CPUC has a deadline of December 31, 2024 to complete the clean energy finance proceeding. The success of these pilot programs hold promise in helping the state accelerate building decarbonization and achieving its clean energy future for all Californians.

1 LMI state incentives include $4,185 Self-Generation Incentive Program, $3,000 Energy Savings Assistance Residential Direct Install Program, $1,000 TECH Clean California incentives, and $519 California Energy Commission Equitable Decarbonization Program.

2 Market-rate state incentives include $3,100 Self-Generation Incentive Program and $1,000 TECH Clean California incentives.