The future of gas in Illinois is fraught with financial risks for customers, utilities and their investors, and even taxpayers. To avoid the worst outcomes of this future, a managed transition that equitably decarbonizes entire neighborhoods and communities is needed.

Download Future of Gas in Illinois

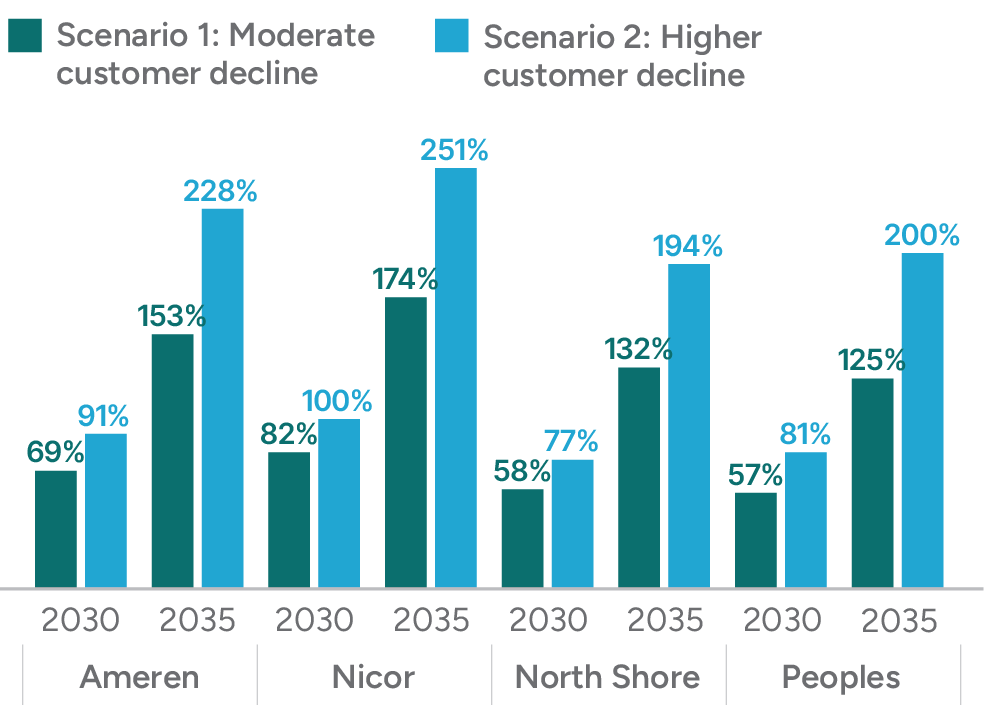

Illinois’ four largest “natural” (methane) gas utilities—Ameren, Nicor, North Shore, and Peoples Gas—continue to spend more than $1 billion each year on gas system infrastructure, even as the state pledges to achieve 100% clean energy by 2050 and customers across the state struggle to pay already unaffordable gas bills. The Future of Gas in Illinois, a new report from BDC and Groundwork Data, finds that without regulatory intervention, unchecked spending on the gas system could triple the gas delivery charges on customer bills in the next decade. By 2035, residential customers across the territory of the four gas utilities can expect an increase in gas delivery charges of $74 per month during the winter in the best case scenario. By 2050, given the trend toward customers departing the gas system for efficient electric appliances, gas charges could climb to $651 per month during the winter.*

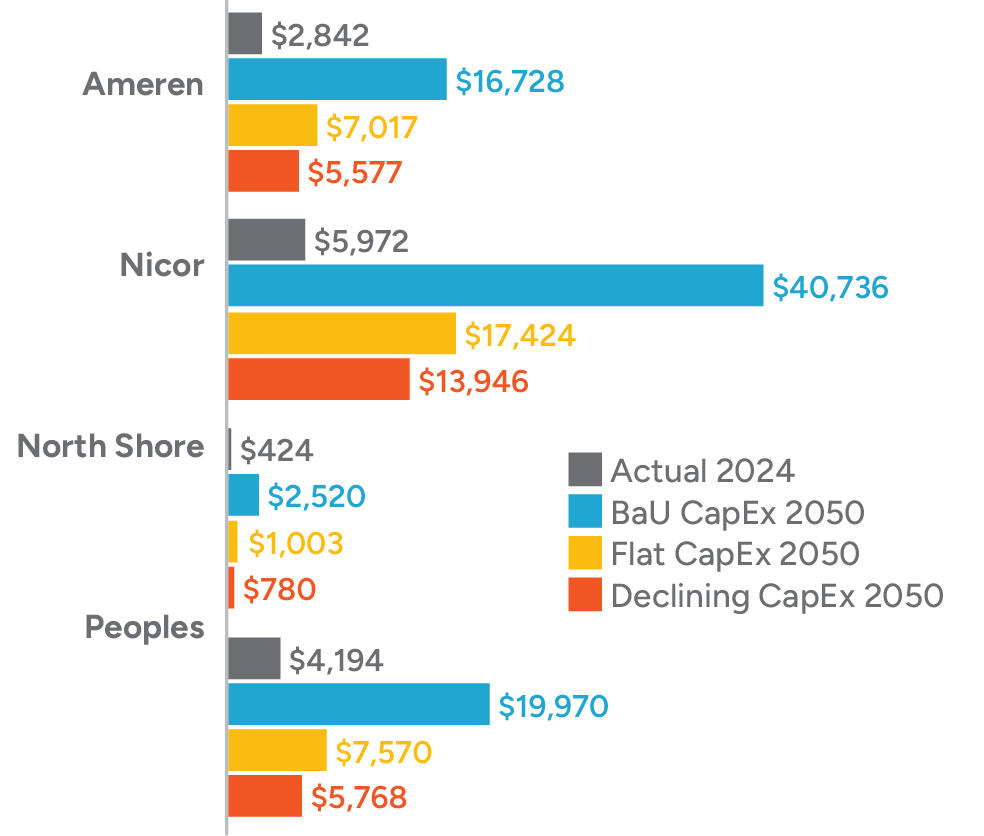

Business-as-usual investment in the gas system puts customers, utilities, investors, and even taxpayers at risk as unrecovered gas system assets are projected to reach $80 billion by 2050—all of which are at risk of becoming stranded as customers flee the increasingly expensive gas system for cost-effective and climate- and health-friendly electric alternatives to gas. This dynamic characterizes the feedback loop of an unmanaged transition: as more customers leave the gas system, increasing costs will be spread across fewer ratepayers, leaving remaining gas customers shouldering even higher gas rates. Since leaving the gas system often requires out-of-pocket expenditures to convert to new space and heating technologies, those staying put are most likely to be lower-income households or renters.

charges) and high (triple delivery charges) customer departures

In addition to the economic risks of an unmanaged transition, the state faces significant health and climate burdens in a future with unchecked gas infrastructure spending. Methane gas combustion in the residential and commercial sectors in Illinois emits about 32 million metric tons of carbon dioxide annually, resulting in a social cost of roughly $7.3 billion each year, per the U.S. Environment Protection Agency’s latest carbon dioxide and methane cost analysis. Pollution from buildings in Illinois accounts for 46% of the state’s energy-related carbon emissions.

However, there is a path forward for the state. A managed transition that centers neighborhood-scale decarbonization can mitigate the inequitable and unevenly distributed effects of an otherwise unmanaged transition off the gas system. Our analysis shows that for every mile of gas line replacement avoided, each customer saves up to $28,145 in direct costs and three times that amount when the return to investors is factored in over the pipe’s 60 year lifespan. These savings can be strategically redirected to decarbonizing neighborhoods with clean energy infrastructure that includes electric heat pumps and thermal energy. These neighborhood-scale solutions can prioritize low- and moderate-income communities by lowering energy bills and pollution while also limiting the impact on ratepayers who remain on the gas system.

Groundwork Data modeling of stranded asset risk based on projection

of unrecovered assets by utility in 2050, each scenario assuming

moderate customer departure with varied levels of CapEx investment

(million $)

An effectively managed gas transition must include clear decarbonization objectives to accelerate change in the building sector along with three categories of gas system management:

- Halting the expansion of the gas system (ICC, Capital Development Board, Municipalities): Stop gas line extension allowances and adopt the new Stretch Energy Code to limit the expansion of the gas system in new buildings.

- Limiting gas pipeline reinvestment (ICC, Utilities): Restrict and reduce capital spending on the replacement of existing gas infrastructure and require non-gas pipeline alternatives, caps on rate base increases, and advanced leak detection and repair.

- Strategically downsizing the gas network (ICC, Utilities, IEPA): Develop a coordinated plan for pruning branches of the gas system and transitioning to neighborhood-scale solutions such as targeted electrification and thermal energy networks.

Read the full report to find out more about the possible futures in store if Illinois continues on a path towards an unmanaged transition, as well as recommendations for how stakeholders can help mitigate these inequitable and costly outcomes through a managed transition off the gas system.

Download Future of Gas in Illinois

*These winter residential customer bill calculations are not included in the body of the report but are based on the report’s findings and assumptions and performed by Groundwork Data. See the methodology here.