A quarterly update on the building decarbonization movement

Q1 | 2025

Authors

Kristin George Bagdanov, PhD, Senior Manager of Policy Research

Kevin Carbonnier, PhD, Market Intelligence Manager

About Our Research

BDC tracks and analyzes policies, trends, and data to accelerate the building decarbonization movement. We synthesize qualitative and quantitative data to produce rigorously researched, substantively contextualized, equitably cited, and endlessly shareable resources that move our movement forward. We believe that research only becomes knowledge when it’s shared, so please share our resources with your communities to help us equitably decarbonize our buildings and neighborhoods.

Also, check out our Q2 | 2025 Momentum Report and Q3 | 2025 Momentum Report.

Table of Contents

I. The Big Picture

II. Market Momentum

III. Neighborhood Scale

IV. Future of Gas

V. Future of Heat

VI. Looking Ahead

I. The Big Picture

What happened this quarter in the building decarbonization movement

This blog offers a holistic view of the state-level policies and trends that work hand-in-hand with communities and market actors to stimulate and sustain the momentum toward decarbonization. While the first quarter of 2025 has presented some uncertainty at the federal level, state-based regulation, legislation, and consumer demand have continued to propel building decarbonization forward.

Signs of progress include the market-shifting impact of simple, yet effective, policy reforms, such as the removal of ratepayer-funded subsidies for expanding the gas system, commonly known as gas line extension allowances. In California, for example, the state’s gas line extension reform, effective July 1, 2023, had a significant impact on the market. According to preliminary data shared by utilities with the California Public Utilities Commission, an overwhelming majority of new service line extension requests in 2023 were for all-electric buildings instead of mixed-fuel buildings (e.g. gas and electric services): customers in two of the state’s largest dual fuel utilities requested service connections for all-electric homes 80% of the time, and connections for all-electric commercial spaces 73% of the time.

Here are a few more signs of progress in the first quarter of 2025:

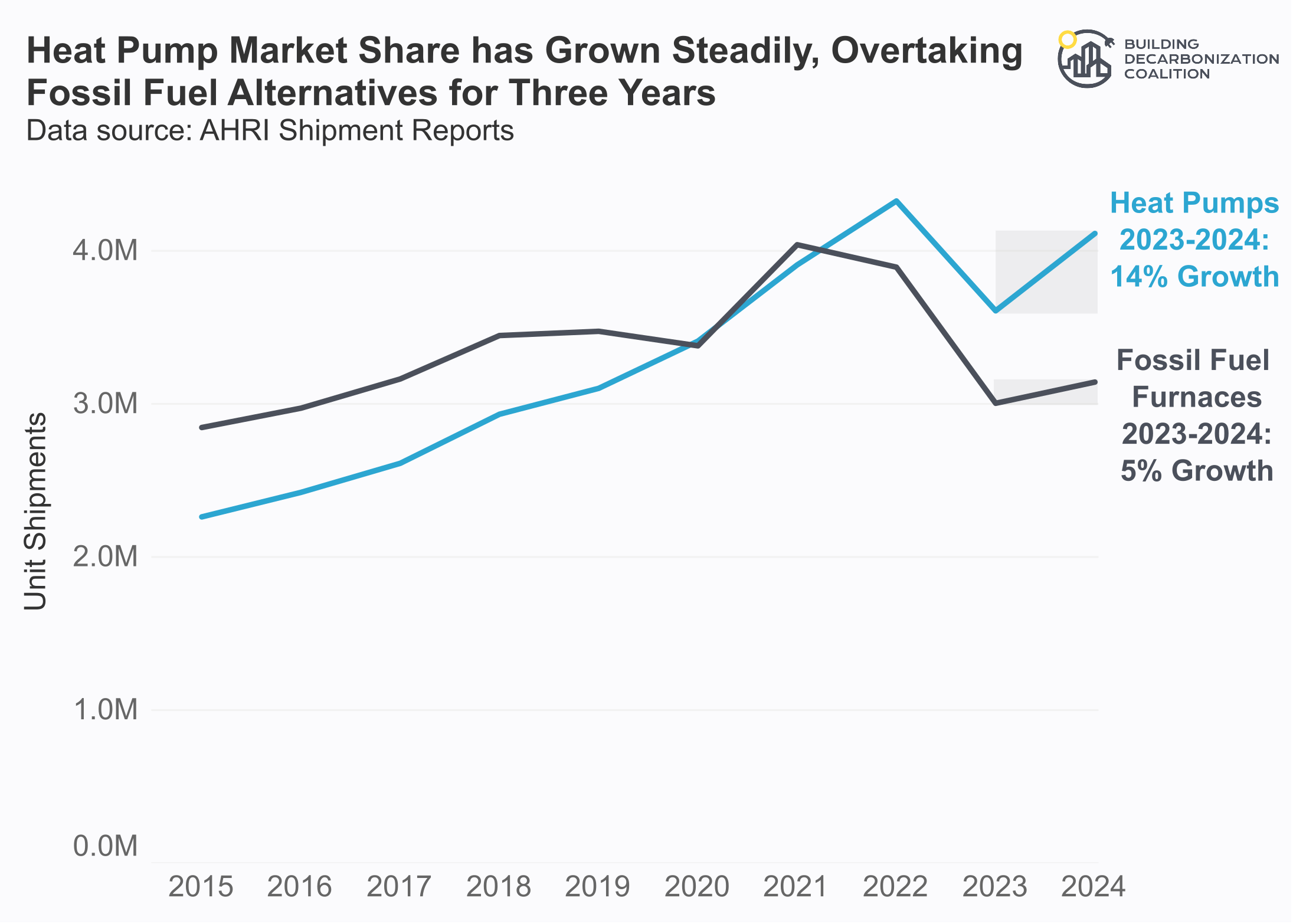

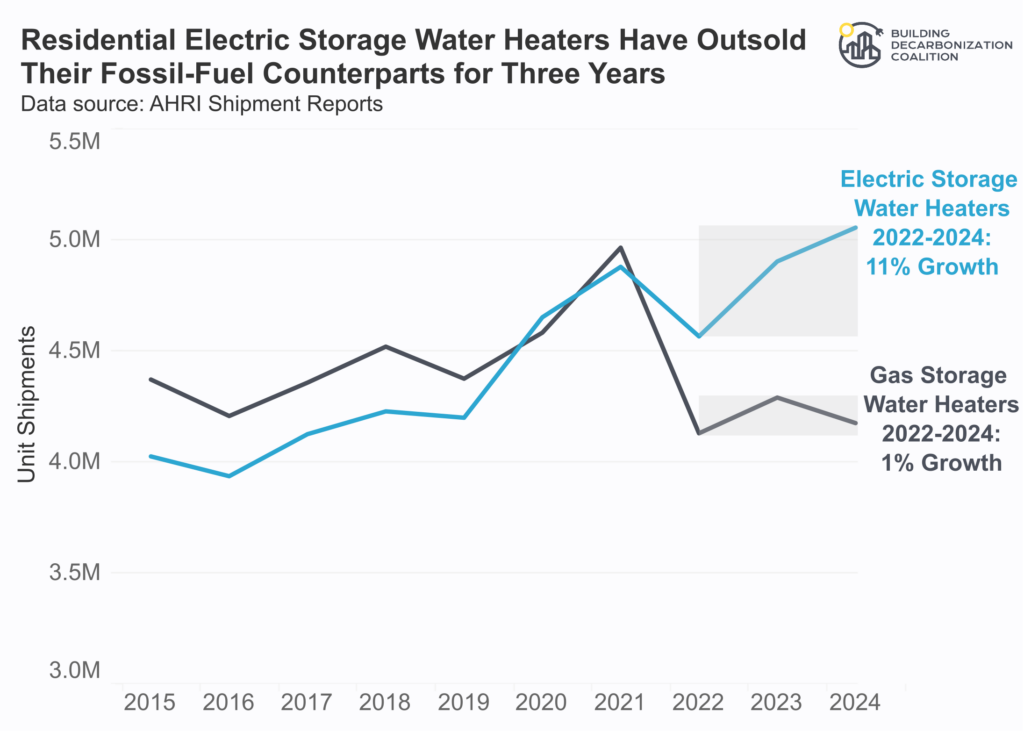

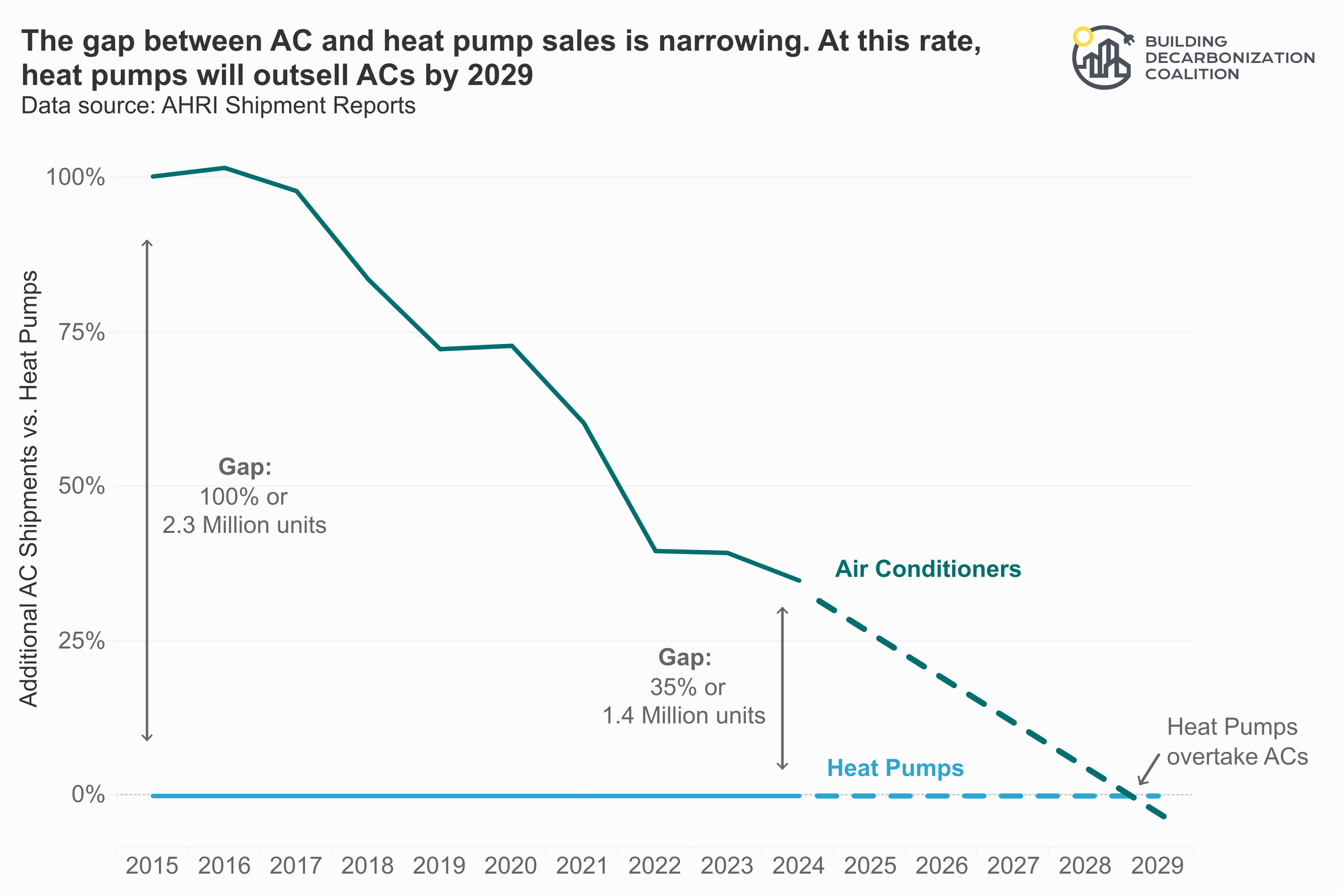

- The electric equipment market is more durable and resilient than the fossil fuel equipment market. Demand for heat pumps flipped the HVAC market on its head in 2021-22 and has been advancing its lead ever since. Over the same period, electric water heaters outpaced fossil fuel water heaters. In addition, since the overall downturn in the space and water heating market in 2022-23, electric equipment proved to be far more resilient than fossil fuel equipment. Looking ahead, we find indications that the same type of market reversal could soon be true for AC and heat pump sales (read all the way to the end for the surprising projection).

- Neighborhood-scale decarbonization is scaling up. We’ve identified 103 unique neighborhood-scale building decarbonization projects, 55 of which are currently operational. The communities we’ve mapped were transitioned from fossil fuel infrastructure onto clean energy infrastructure, meaning they weren’t built electric from the start. Of these 103 projects, 20% are owned by utilities, which signals a shift from private owners and universities as the primary investors in these projects to an infrastructure-scale investment benefiting utilities and communities.

- Regulators are reshaping the future of gas through long-term planning, gas subsidy removal, and non-gas-pipeline alternatives. With 13 Future of Gas proceedings (e.g. long-term gas planning dockets) in the past five years, and at least one more soon to be opened, regulators are establishing new norms and procedures for evaluating and planning out the long-term future of the gas system. Complementary proceedings, such as the recent re-evaluation of the Peoples Gas System Modernization Program, have also become sites of innovation and change.

- The pathway to clean heat is being built through innovative regulations and legislation. Proceedings concerning the implementation of utility-owned thermal energy networks, the creation of clean heat standards, and the design of zero-NOx (nitrogen oxides) regulations are addressing emissions at every phase of the heat production and delivery system. And with new legislative sessions in full force, we are seeing dozens of bills across the U.S. that focus on the solutions side of the equation: ramping up ratepayer protections, streamlining permitting, supporting non-gas-pipeline alternatives, funding thermal energy network pilots, and developing workforce training programs.

Demonstrating the durability of decarbonization

Equipment Sales

HVAC equipment shipment data from AHRI is a key data source to track market trends, including the transition away from fossil-fuel space heating equipment toward electric heat pumps. AHRI reports monthly shipments from US manufacturers of unitary HVAC equipment, including air conditioners, fossil-fuel furnaces, and heat pumps. Looking back over the last ten years, the market share of space heating equipment has flipped in favor of heat pumps, which are steadily gaining market share year over year.

The growth in heat pumps for space and water heating is driven by multiple factors, including:

- Development of cold-climate heat pumps that work effectively below 0°F

- Incentive programs

- Federal income tax credits

- Supportive electric heating utility rates

- Lower equipment costs as the heat pump market scales up

- Contractor adoption and awareness

- Consumer education

- Improved lifecycle costs over legacy technologies

- State and local commitments to deploy heat pumps

- 120-volt options coming to market for heat pump water heaters and HVAC heat pumps

In the residential water heater market, electric storage water heaters (combines electric resistance and heat pump water heaters) have similarly overtaken gas storage water heaters, with majority market share crossing over between 2020 and 2022 in favor of electric equipment after a persistent drop in gas storage water heater shipments since 2022.

Together, these two charts reveal an undeniable trend—the electric equipment market is more durable and resilient than the fossil fuel equipment market. There is a clear inflection point for both markets in 2021-22 when electric equipment sales overtake fossil fuel equipment sales. It is perhaps not possible to locate a single cause for this inversion, but the rollout of pre-IRA, state-funded clean energy rebate and awareness programs, such as those in early adopter states California, Massachusetts, and New York, combined with the increase of building decarbonization policies and proceedings since 2019 (such as the Future of Gas) likely catalyzed this surge.

In addition, since the nadir of the overall downturn in the space and water heating market in 2022-23 (and the market at large due to high inflation and supply chain issues), electric equipment proved to be far more resilient than fossil fuel equipment: heat pumps rebounded at a rate of 14% (compared to the furnace rebound growth rate of 5%) while electric water heaters rebounded at a rate of 11% (compared to the gas water heater rebound growth rate of 1%). This resiliency is likely due to the well-established ecosystem of symbiotic policies, incentives, awareness, and demand (including an overall increased demand for cooling for the HVAC market).

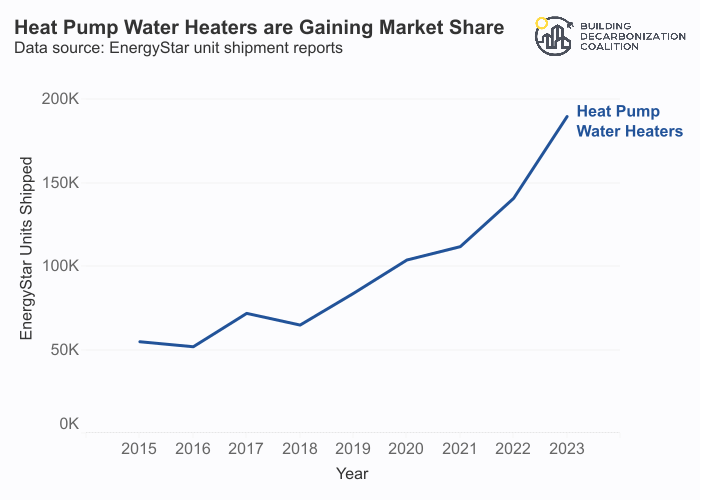

The heat pump water heater (HPWH) market is similarly growing. EnergyStar tracks annual shipments of certified technologies, including electric and gas water heaters (AHRI does not report HPWHs separately in their water heater data, so the chart above groups electric resistance and HPWH together). The latest available data from 2023 reports a 35% annual growth in heat pump water heater shipments while EnergyStar certified methane gas systems are on the decline.

Zero-Emission Building Codes

Electrification codes enable long-term investments in electric equipment, which in turn send a positive signal to manufacturers, distributors, and the clean energy workforce that the electrification market is durable.

To date, there are 152 policies throughout 11 states and D.C. that require or encourage electric equipment in new and/or existing buildings. Together, these policies affect 25% of the U.S. population, offering a strong indication of where the market is headed.

Scaling up building decarbonization, block by block

Our neighborhood-scale project map tracks projects across North America, ranging from fully decarbonized neighborhoods to early plans to transition from fossil fuels. This crowdsourced map is constantly being updated with new projects and we need your help to keep it current. Please submit neighborhood-scale projects for consideration here.

Note that all of the neighborhoods tracked here have been transitioned from a fossil fuel system to a non-emitting electric and/or thermal energy system. In other words, we are not tracking communities built electric from the start, of which there are many. This map demonstrates the momentum of the work of decarbonizing existing neighborhoods, transitioning them from aging gas infrastructure onto clean energy infrastructure.

Projects

- 103 total projects logged so far

- 55 projects are currently operational

- 20% are owned by utilities

- 38% are owned by universities

- 42 projects are Thermal Energy Networks or Geothermal Networks

See our full Neighborhood Scale Map on our webpage for additional information and functionality.

Project Highlight: Framingham, MA

- Framingham, Massachusetts, is home to the nation’s first operational utility geothermal network (GEN). Non-utility GENs already heat and cool buildings across the country. But Eversource Energy’s June 2024 launch was the first time a utility converted a neighborhood from gas to geothermal—making it a big deal for neighborhood-scale building decarbonization.

- Read more about the project and BDC’s recent site visit here.

Enabling an equitable, managed transition off the methane gas system

The “Future of Gas” is an evolving policy framework that designates a set of questions, assumptions, and arguments associated with the long-term sustainability of the methane gas system. The phrase has been used explicitly by researchers, state energy offices, legislators, and utility regulators to describe policies, reports, and proceedings since at least 2019. It has also been applied retroactively by advocates to demonstrate the growing trend of regulators and legislators who are critically examining the longevity of the gas system.

Chart concept credited to RMI, “The Impact of Fossil Fuels in Buildings” Fact Base (2019).

Data source: EIA, 2022.

The Future of Gas framework is essential for aligning and coordinating the otherwise pixelated gas utility landscape. Regulated utilities adhere to standards set by their state utility commissions, which are directed by laws that vary state by state. The more than 1,136 gas utilities across the U.S. typically plan their system investments on a near-term cadence that does not necessarily interact or align with the broader energy landscape or state and local climate goals. However, as these Future of Gas proceedings catch on, commissions across states are beginning to develop and follow a common scope of concerns. Learning from other states is helping to harmonize not only the utilities within each state but the utilities across the U.S. This cross-state regulatory alignment is creating momentum and stability while illuminating the path forward for aligning gas system investments with climate goals.

Future of Gas Proceedings

Since 2020, over a dozen Future of Gas regulatory proceedings have led to key insights on the inequitable distribution of methane pollution, the risks of business-as-usual gas system growth, and the urgency of reforming outdated policies. A managed, neighborhood-scale transition off the gas system requires clear decarbonization targets to halt expansion, limit reinvestment, and right-size the system.

For a comprehensive list of Future of Gas proceedings, including closed and inactive dockets, see BDC’s public tracker.

Q1 FOG Proceeding Activity

|

State |

Recent Activity |

|

New York Proceeding on Motion of the Commission in Regard to Gas Planning Procedures (Docket # 20-G-0131) (2020-present) Associated dockets: 24-G-0248 , 23-G-0676 , 23-G-0437 , 23-G-0147 , 22-G-0610 |

The NY gas planning docket (20-G-0131) has evolved since its original impetus to address gas moratoria; as such, the NY PSC opened separate dockets for each utility’s cyclical long-term gas planning process. Gas utilities in NYS are required to make filings with proposed long-term gas plans (LTGP) every three years. The filings must include at least one scenario with no new traditional gas infrastructure and quantify the impact on greenhouse gas emissions. Each filing begins a stakeholder engagement process, aimed at developing a consensus long-term plan. Utilities are also required to provide annual updates to their LTGPs. Below are the Q1, 2025 docket activities for each associated utility docket and LTGP:

|

|

Massachusetts The Future of Gas (Docket #: 20-80) (2020-present) |

In 2024, the Dept. of Public Utilities (DPU) directed its attention to examining existing gas line extension policies (LEAs), directing gas utilities to report on their LEA practices by August 2024. Advocates and other invested parties submitted comments responding to these reports in October 2024. The DPU is now soliciting reply comments on previously filed comments as well as any aspects of the draft LEA policy by the end of March 2025. The revised policy proposes that new gas customers pay the full cost of connection to the gas distribution system, with few exceptions, and that “no costs associated with a new service or line extension shall be deemed prudently incurred and, thus, eligible for inclusion in an LDC’s rate base.” (Feb. 5, 2025 Memorandum). In addition, the Non-Pipeline Alternatives (NPA) working group met from Oct. 2024 through March 2025 “to collect diverse perspectives to help shape a comprehensive NPA framework.” Materials for that working group can be found here. |

|

D.C. In the Matter of the Implementation of Electric and Natural Gas Climate Change Proposals (Docket # 1167) (2020-present) |

In response to Order No. 22313 (Oct 10, 2024) directing utilities to file revised 15-year Climate Solutions and Climate Business plans, advocate intervenors suggested requiring Integrated Distribution System Planning (“IDSP”); under an IDSP, instead of each utility creating a separate plan, they would develop coherent, coordinated plans following a unifying framework and set of assumptions, as has been established in MA, MD, NY, and IL. Intervenors suggested opening a separate docket focused on electrical distribution planning and another docket for gas to focus on clean energy and non-gas-pipeline alternatives to gas infrastructure. These separate dockets would address an additional concern expressed by stakeholders–namely that Formal Case No. 1167 is “overly broad” and therefore limits meaningful stakeholder feedback. Responding to these and other suggestions and concerns, the Commission decided to open a new docket for IDSP (Formal Case No. 1182) and is seeking input from stakeholders on establishing a new thermal gas planning proceeding. (Order No. 22339). Initial comments were due March 27, 2025 and reply comments are due May 12, 2025. |

|

Minnesota In the Matter of a Commission Evaluation of Changes to the Natural Gas Utility Regulatory and Policy Structures to Meet State Greenhouse Gas Reduction Goals (Docket #: G-999/CI-21-565) (2021-present) |

In January 2025, the Commission issued an updated scope and timeline to return to the state’s Future of Gas proceeding. In the coming months, the Commission intends to hold planning meetings to better understand issues related to the Future of Gas in Minnesota. Topics in these meetings to include: 1. Gas utility winter readiness 2. Renewable natural gas 3. Rate design to support hybrid heating 4. Alternative fuels (e.g. hydrogen) 5. An update on progress via the Commission’s thermal energy network work group. In parallel, the Commission intends to open two comment periods to consider changes to current line extension allowance policies and rate design to align with electrification and state emissions reduction goals. |

|

Illinois The Future of Natural Gas and issues associated with decarbonization of the gas distribution system (Docket # 24-0158)(2024-present) |

Phase 2A (Aug-Feb 2025) recently concluded. This phase explored decarbonization pathway options and technologies. Phase 2B (March-June 2025) commenced on March 17, 2025 with the intention to explore decarbonization pathways as well as a process for pilot selection. Working Groups will be organized and facilitated by the Facilitator and Commission Staff. |

Accelerated Pipeline Replacement Programs

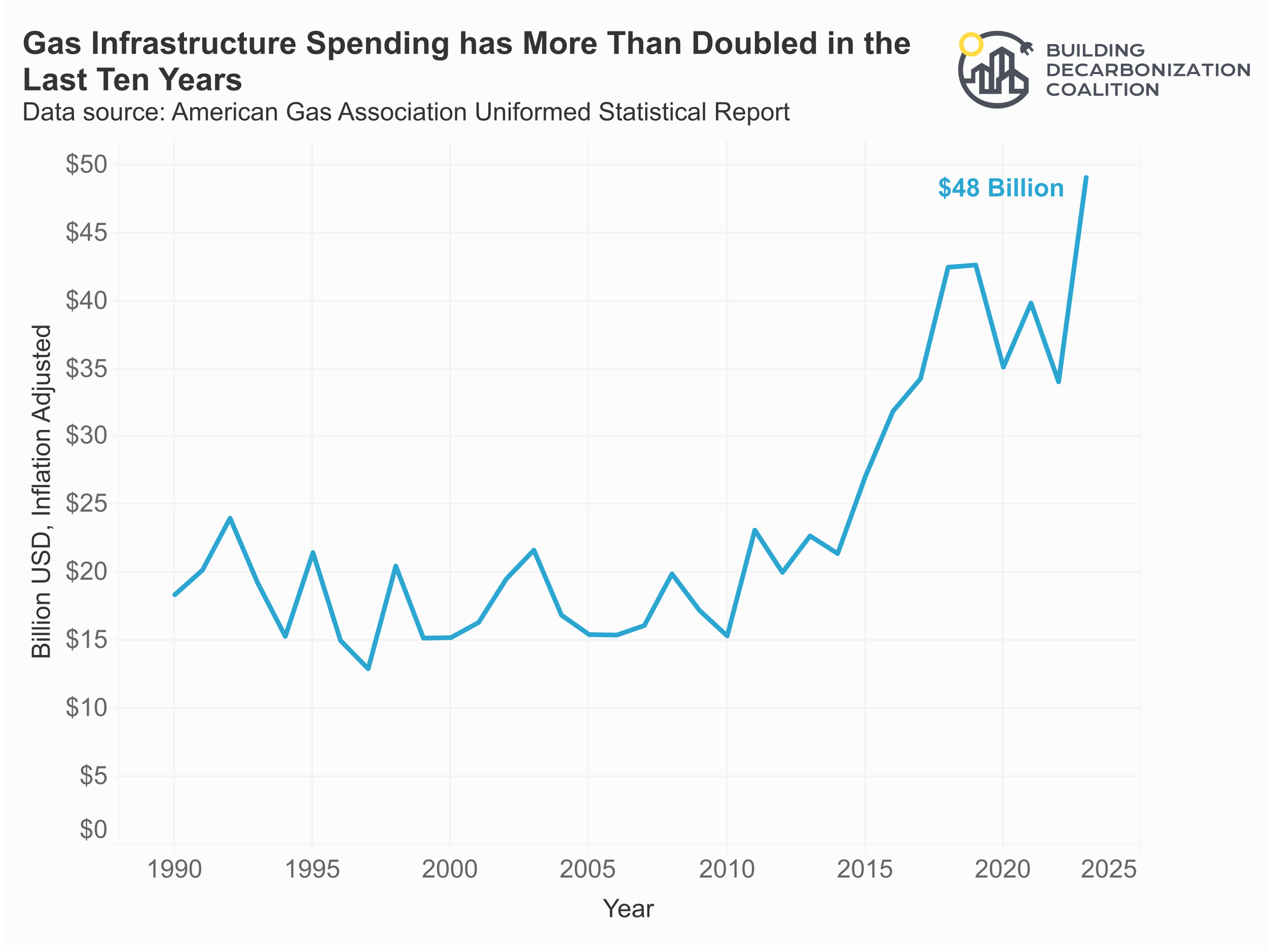

Gas utilities are spending billions of dollars each year on the gas system, reaching new heights in 2025—$48 billion—according to the American Gas Association. These long-lived assets pose substantial financial, economic, safety, and health risks as they perpetuate an emitting system that we should be actively transitioning away from in order to meet our climate goals. Spending has accelerated in the past decade, thanks in part to several “accelerated” pipeline replacement programs, which typically allow for accelerated cost recovery through surcharges on customer bills.

While Future of Gas dockets offer an opportunity to address near- and long-term concerns associated with future gas system investments, a new batch of proceedings and bills are scrutinizing these accelerated pipeline replacement programs.

Two programs that have recently come under closer regulatory scrutiny are the Peoples Gas System Modernization Program (SMP) in Chicago, IL and the Washington Gas and Light (WGL) ProjectPIPES program in Washington D.C. Another program being addressed through the legislature this year is Maryland’s 2013 STRIDE (Strategic Infrastructure Development and Enhancement Plan) law. The recently introduced Ratepayer Protection Act (HB0419) seeks to narrow the scope of this program to solely focus on high-risk pipelines to improve safety, not to expand the gas system.

Several other states currently have accelerated pipeline replacement programs: Massachusetts, New York, Minnesota, Pennsylvania (Philadelphia), Idaho, Oregon, and Washington. While the Massachusetts legislature reformed several aspects of GSEP (Gas System Enhancement Plan) in 2024 through S. 2967: An Act Promoting a Clean Energy Grid, Advancing Equity, and Protecting Ratepayers, the bulk of these programs have not yet been subjected to the level of scrutiny needed to ensure these programs are targeting high-risk pipelines rather than gas system expansion. Dorie Seavey and HEET’s 2024 report, Leaked & Combusted offers more insight on the costs associated with these programs.

Reasons to Reform Accelerated Pipeline Replacement Programs:

- Overly-broad scopes: Utilities are charging ratepayers extra to not only replace the most high-risk pipes but to replace the whole system, locking ratepayers into 60-75 years of excess charges

- Excessive spending:

- Peoples Gas initially estimated the program would cost $2 billion in total; however, by 2024 the program had already cost $11 billion and the utility projected it would cost another $12.8 billion to complete by 2040 (almost 12 times the original amount).

- WGL has increased their budget for each phase of the ProjectPIPES program while at the same time spending more and more per mile, far exceeding their cost per mile pre-PIPES. Synapse Energy reports that the “average annual spend per mile more than doubled from pre‐PIPES to PIPES 1 and increased by nearly 70 percent from PIPES 1 to PIPES 2.” (Pg. 6)

- According to the Office of People’s Counsel, “Maryland’s gas utilities have spent more than $2.1 billion on new gas infrastructure…under STRIDE. By 2043, they are projected to spend another $7.2 billion, and ratepayers will have paid about $11.3 billion…As of today, customers have paid only about three percent of what STRIDE will ultimately cost them. If the spending continues unchecked, ratepayers will be expected to pay more than $31.3 billion by 2100 for STRIDE alone.”

- Stranded asset risk: Replacing low-risk and/or non-essential pipelines with new pipelines that will be depreciated for the next 60 years, well beyond most states’ net-zero emissions goals, raising the question of who will ultimately be paying for this underutilized gas infrastructure. Stranded assets are a financial risk for ratepayers, utility shareholders, and taxpayers.

- Mismanagement: An audit of WGL’s ProjectPIPES program found that “if the Public Service Commission and other stakeholders plan to continue investment in PIPES 2 and future PIPES programs, changes to program design and management are needed” (Pg. 8). Since 2007, several audits and official investigations into the Peoples Gas SMP have revealed mismanagement and poor program design (Pg. 19).

- Pace of replacement: The pace of replacement and timelines for completion have been extended for WGL and Peoples Gas “accelerated” pipeline replacement program. According to IL CUB, “Given Peoples Gas’ replacement rate of 58 miles of main per year (2018-2023)…the program would extend to 2051.”

- and more.

Q1 Activity to Reform Pipeline Replacement Programs

|

Illinois: People’s Gas System Modernization program |

In 2023, The ICC paused the SMP to investigate the underperforming and over-budget pipeline replacement program. The investigation found that Peoples Gas did not adequately prioritize high-risk pipeline and over-spent on less essential pipeline replacement. The final order, issued on February 20, 2025, rejected each of the company’s proposed pathways and instead directed them to target the retirement (and replacement) of the remaining high-risk 1,112 miles cast iron and ductile iron pipes by 2035 (or approx. 111/miles a year–a pace more than double what the utility has been achieving in recent years). No expenditures were approved or denied as a part of the investigation. Next quarter a non-pipeline alternatives workshop will be launched to explore cost- and climate-effective alternatives to installing new gas pipelines. |

|

Washington, DC: Washington Gas and Light’s ProjectPIPES Program |

On December 22, 2022, WGL filed its PIPES 3 proposal, a five-year program that was estimated to cost $671.8 million. In June 2024, the DC PSC dismissed the plan and directed WGL to submit a revised plan that better aligned with the District’s climate objectives and focused on high-risk pipe replacements. WGL resubmitted their plan, now called the “Strategic Accelerated Facility Enhancement” or “SAFE” Plan in September 2024. The new plan proposed spending $215 million over three years to replace 12.4 miles of main and 3,608 services. The OPC and other advocates urged the Commission to reject the proposal given that it did not adhere to the requirements of the recent Order, such as exploring non-pipe alternatives like electrification and addressing what to do about stranded assets. The Commission did not dismiss or approve WGL’s new plan, but extended the period for comment and response while also extending the current ProjectPIPES 2 surcharge through the end of 2025. |

|

Maryland: Strategic Infrastructure Development and Enhancement Plan (2025 reform bill: Ratepayer Protection Act, HB0419) |

The legislature is currently considering a bill that would reform the state’s 2013 law called the Strategic Infrastructure Development and Enhancement Plan (STRIDE), which sanctioned a ratepayer surcharge to fund accelerated gas pipeline replacements. Advocates argue that STRIDE has shifted the risks of utility overspending to customers and increased customer rates significantly since gas utilities have implemented gas pipeline replacement programs, many of which have not achieved what they promised to at the outset. The bill seeks to narrow this overly broad scope to focus on high-risk pipe while also requiring the evaluation of non-gas-pipeline alternatives. |

Empowering communities, transitioning workers, and achieving our climate goals through clean energy infrastructure

The future of heat represents the solutions side of the managed gas transition: the infrastructure, technologies, policies, and programs that we can build up while winding down the gas system. Synchronizing this transition will help achieve a thoughtful and equitable pathway for workers, utilities, ratepayers, and communities.

Regulation

Q1 activity in proceedings and standards that are focused on implementing solutions to gas system expansion and emissions.

|

State / Rule or Regulation |

Recent Activity |

Category |

|

California, Appliance Standards (state and regional air regulatory boards) |

This year, the California Air Resources Board (CARB) began listening sessions for the rulemaking process on the Zero-Emission Space and Water Heating Standard, which would include a rule that ensures gas appliances are replaced with efficient electric ones upon the gas equipment’s burnout (e.g. end of serviceable life). In addition, regional air districts have begun to implement zero-NOx space and water heating rules: The Bay Area Air District (BAAQMD) adopted a zero-NOx rule for residential space and water heating starting in 2027; the South Coast Air Quality Management District (SCAQMD) will vote on rules for residential appliances later this year, following passage of the commercial water heating ruling in 2024. |

zero-emissions appliances, air regulation |

|

California, Rulemaking Regarding Building Decarbonization (R. 19-01-011) |

The Building Decarbonization Rulemaking was opened in 2019 following the passage of SB 1477, which provided funding via the GHG emissions cap-and-trade program for two building electrification pilot programs: the Building Initiative for Low-Emissions Development (BUILD) Program and the Technology and Equipment for Clean Heating (TECH) Initiative. On March 16, 2025, Commissioner Houck submitted a proposed decision regarding Phase 4 Track A. This proposed decision authorizes up to $5M annually through 2029 for electric service line upsizing to under-resourced customers seeking to fully electrify their homes and businesses and adopts measures to prevent unnecessary service upgrades. It also proposes extending the energization deadline for mixed-fuel new construction to receive electric line extension allowances, due to the protracted process of energization (which takes So. Cal. Edison an average of 268 days). They propose allowing a 36 month extension from July 1, 2024 (i.e., the date of implementation of the Phase 3B Decision eliminating these allowances) for mixed-fuel new construction projects with contracts approved and fully paid for prior to this date, with an end date no later than June 30, 2027. In addition, they propose increasing the frequency and granularity of utility reporting on line extensions. Finally, this proposed order authorizes an additional $40M in funding (from the Aliso Canyon Recovery account) for the TECH Initiative to be used in SoCalGas territory. |

line extension allowances, rebates and incentives |

|

California, Rulemaking to Establish Policies, Processes, and Rules to Ensure Safe and Reliable Gas Systems in California and Long-term Gas System Planning (R.24- 09-012) [Implementation of Neighborhood-scale pilots] |

In September 2024, the California PUC issued an Order Instituting a Rulemaking following the passage of SB 1221, a landmark bill authorizing neighborhood-scale decarbonization pilots in the state. The law requires gas utilities to provide maps of planned gas projects by July 1, 2025 and to submit maps designating priority zones by January 1, 2026. The CPUC will need to establish a voluntary program by July 1, 2026, through which gas utilities can apply for up to 30 pilot projects. The bill modifies the “obligation to serve” law by reducing customer consent thresholds for new projects from 100% to 67%. In Q1, the CPUC proposed “Recommendations for SB 1221 California Natural Gas System Mapping” and is currently receiving comments on the staff proposal. |

neighborhood scale, electrification, obligation to serve |

|

Colorado, Black Hills Clean Heat Plan (23A-0633G) |

A January 2025 Decision by Colorado’s public utility commission marked the first time a gas-only utility has been directed to help customers electrify their homes and businesses, including pre-electrification weatherization and energy efficiency measures. The decision is the result of the state’s 2021 Clean Heat Plans (SB21-264), a law that directs gas utilities to develop plans to reduce the greenhouse gas emissions. |

clean heat standards, electrification |

|

Maryland, Clean Heat Standard |

Maryland is developing a Clean Heat Standard (CHS) that will require that the thermal sector reduces emissions from heating delivery services and transitions to clean heating services and technologies, including installing zero-emission heating equipment (e.g. heat pumps), weatherizing buildings, and delivering cleaner fuels. Stakeholders are currently weighing in on the development of the standard with the goal of adopting a reporting rule by Fall 2025. |

clean heat standard, electrification |

|

Maryland, Zero Emission Heating Equipment Standards (ZEHES) |

Following Gov. Moore’s 2024 Executive Order, the Maryland Dept. of Environment accepted stakeholder comments through early January on the proposed rule to address harmful NOx and GHG emissions through the phaseout of fossil fuel heating equipment. Stakeholders are currently working toward developing a draft of the rule by May 2025 with the goal of adopting a final rule by Fall 2025. |

zero-emissions appliances, NOx and GHG standards |

|

New York, Utility Thermal Energy Network and Jobs Act (UTENJA) |

Since being directed by the 2022 UTENJA law, New York utilities have been exploring how they can use thermal energy networks to decarbonize entire neighborhoods in different communities across the state. There are currently 11 proposed pilot projects being considered by the Public Service Commission (PSC). This quarter, utilities filed requests and were granted extensions to allow for more time to develop final engineering plans. These filings are now due in summer 2025, with different due dates depending on the project. The Department of Public Service also held a technical conference on March 25th to explore lessons that can be learned from already-existing thermal energy networks. |

thermal energy networks; workforce; neighborhood scale |

Legislation

Proposed bills that seek to develop, support, and enable clean energy alternatives to the gas system.

Below are a few of the bills we’re watching this quarter:

|

State / Bill |

Description |

Categories |

|

California, The Heat Pump Access Act (SB 282) |

Standardizes permitting for heat pumps across the state, caps permit fees, and requires a maximum of one permit for heat pump installation to make the process simpler, faster, and more affordable for homeowners and contractors. |

permitting, electrification |

|

California, Local Electrification Planning Act (AB 39) |

Requires local jurisdictions to adopt an electrification plan with climate strategies and goals to meet their communities’ energy needs. |

electrification; long-term planning |

|

Colorado, Utility On-Bill Repayment Program Financing (HB25-1268) |

Requires investor-owned utilities that serve more than 500,000 customers to establish or expand on-bill repayment programs to expand affordable access to efficient electric appliances and measures. |

ratepayer protections; affordability; financing |

|

Connecticut, Thermal Energy Network Loan and Grant Program (HB 6929) |

Create a grant and loan program to develop neighborhood-scale thermal energy networks. |

funding; thermal energy networks |

|

Allows investor-owned utilities to pilot up to three thermal energy network demonstration projects in their territories; including at least one in an environmental justice community. A recent amendment also allows for up to one industrial pilot per territory. The bill also supports workforce development and training for clean energy infrastructure and includes ratepayer and consumer protections. |

thermal energy networks; workforce; ratepayer protections |

|

|

Maryland, Better Buildings Act 2025 (HB973/ SB804) |

All-electric new buildings: this bill would require all newly constructed buildings to meet space and water heating needs without fossil fuels (A version of this bill was introduced last year but was held). |

electrification; codes & ordinances |

|

Massachusetts, An Act Relative to a Tactical Transition to Affordable, Clean Thermal Energy (SD.1924) |

Builds on the state’s Future of Gas Docket (20-80) and last session’s climate law by redirecting gas pipeline replacement funds to non-gas-pipeline alternatives to new gas pipelines; removing ratepayer funded gas pipeline subsidies for new customers; and requiring gas and electric utilities sharing the same territory to develop joint tactical thermal transition plans. |

neighborhood scale; line extension allowances; integrated system planning; regulation |

New York, NY HEAT Act (S 4158/A4870A): |

Aligns utility regulation with state climate justice and emission reduction targets by launching a planning process and amending utilities’ “obligation to serve” methane gas, enabling neighborhood-scale electrification like thermal energy networks by re-directing spending from new gas pipelines. It aligns provisions of the state’s public service law with New York’s Climate Act, ends gas line extension subsidies, and reduces energy burdens by directing the PSC to plan to use all available tools to protect customers from energy burdens greater than 6% of their income. |

line extension allowances; ratepayer protections; non-gas-pipeline alternatives |

|

Washington, Encouraging the Deployment of Low Carbon Thermal Energy Networks (HB 1514): |

Proposes a regulatory environment for thermal energy network projects to provide regulatory certainty for thermal energy companies and customers. |

thermal energy networks; regulation |

There is so much to look forward to in the building decarbonization space this quarter, this year, and this decade.

The growth opportunity for heat pumps (which we also call “two-way-ACs”) in particular is substantial, as global temperatures continue to rise and households add air conditioning to combat extreme heat. While air conditioners have always outsold heat pumps, the gap has narrowed significantly in the past decade. In 2015, air conditioners outsold heat pumps two-to-one. But as of 2024, that gap narrowed to just 35%! At this rate, we could see AC and heat pump sales equalizing in 2028, with heat pumps taking the lead soon after. While there is still some ground to cover, the slope is steep and our momentum is powerful.

While taking the lead over AC sales is an important milestone for heat pumps, it is not the finish line. To widen that lead into durable and resilient market momentum, an array of supportive policies is needed, such as “AC-to-Heat-Pump” policies that seek to reduce the inefficient duplication of HVAC systems by ensuring the heat pump equipment serves both heating and cooling loads.

As supportive building decarbonization policies continue to be introduced across the U.S. and legislative sessions stagger to a close across the rest of the calendar year, we will be tracking and analyzing the trends and performance of these policies compared to years past. While regulatory proceedings advance at a slower pace than bills, these discussions on rates, gas system investments, clean heat standards, and appliance emissions are critical factors in building out the solutions side of the future of heat, and we will be awaiting key decisions in cases in several states in the coming year.

Be sure to join us next quarter as we take stock of the building decarbonization movement’s progress.