A quarterly update on the building decarbonization movement

Q2 | 2025

Authors

Kristin George Bagdanov, PhD, Senior Manager of Policy Research

Kevin Carbonnier, PhD, Senior Manager of Market Intelligence

About Our Research

BDC tracks and analyzes policies, trends, and data to accelerate the building decarbonization movement. We synthesize qualitative and quantitative data to produce rigorously researched, substantively contextualized, equitably cited, and endlessly shareable resources that help move our movement forward. We believe that research only becomes knowledge when it’s shared, so please pass along these resources to your communities and help us equitably decarbonize our buildings and neighborhoods. Read more about our research philosophy, resources, and reports.

Also, check out our Q3 | 2025 Momentum Report and Q1 | 2025 Momentum Report.

Table of Contents

I. The Big Picture

II. Market Momentum

III. Neighborhood Scale

IV. Future of Gas

V. Future of Heat

VI. Looking Ahead

I. The Big Picture

What happened this quarter in the building decarbonization movement

This report offers a holistic view of the state-level policies and trends that work hand-in-hand with communities and market actors to stimulate and sustain the momentum toward building decarbonization. Amidst federal policy reversals and global supply chain turmoil, state-level activity on climate change continues to serve as an example for the pathway forward.

Here are a few signs of progress in the second quarter of 2025:

- HVAC heat pumps continue to outsell furnaces, with 2025 sales off to a strong start.

- BDC’s neighborhood-scale project map grew by 20% this quarter, with new projects including thermal energy networks at a zoo, a non-profit housing initiative, and a City Hall.

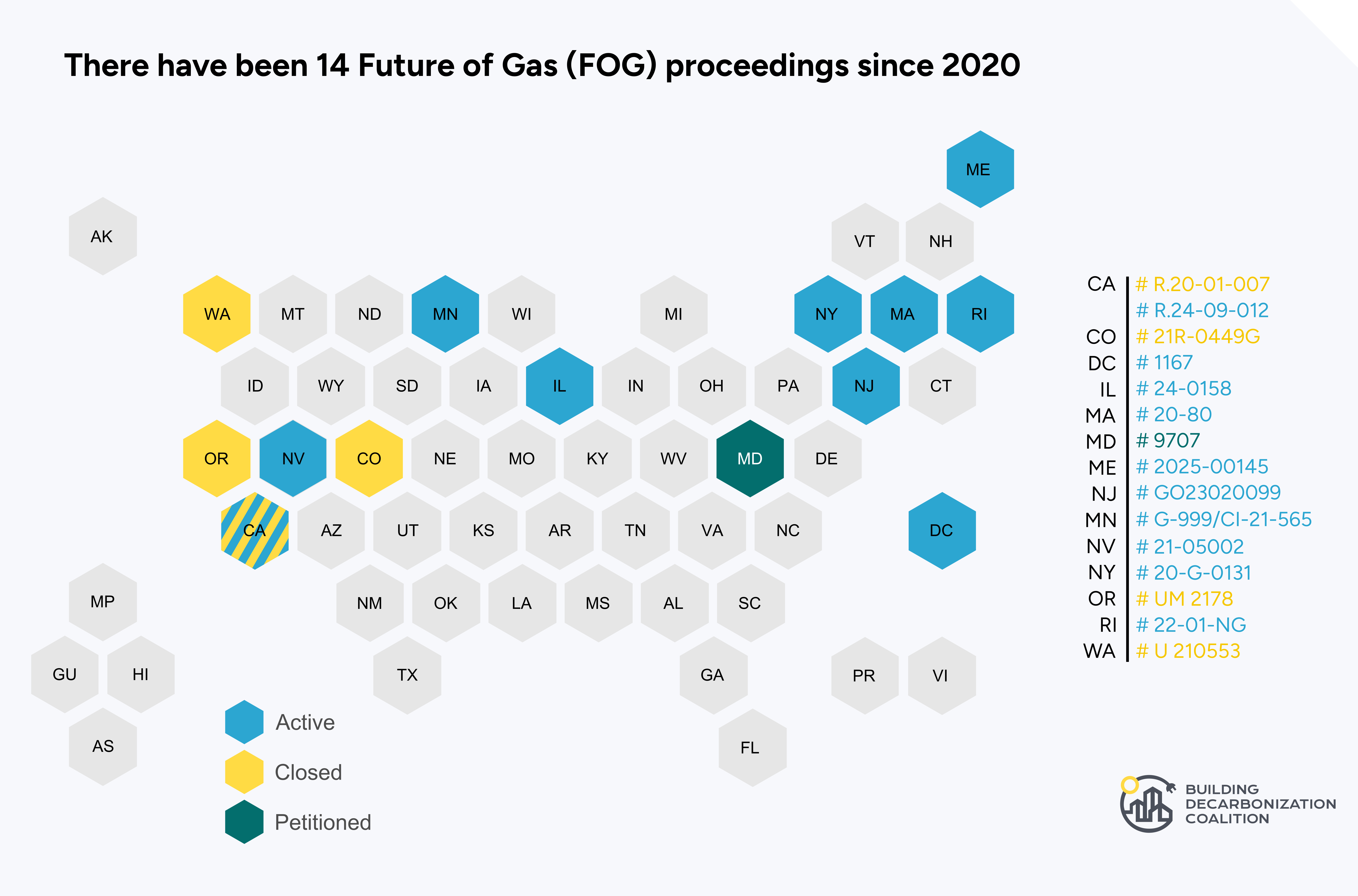

- A new Future of Gas proceeding in Maine brings the total of these critical proceedings to 14 since 2020.

- A gas-only utility in Oregon will pilot a neighborhood-scale electrification project.

- D.C. ratepayers could save $244M over the next decade if utilities pursue neighborhood-scale decarbonization instead of business-as-usual gas pipeline replacement, according to a newly filed report.

- Maryland and Massachusetts enact major reforms to their gas pipeline replacement programs.

- Gas Line Extension Allowances (LEAs) are being revoked: New York passes a law to remove its “100 foot” gas subsidy rule, which when paired with the existing All Electric Building Act, effectively stymies residential gas expansion in New York State; and in Maryland, the PSC announced that staff will propose a new set of gas LEA regulations this winter, indicating it will recommend removing them completely.

- New York State makes a historic $200 million investment in thermal energy networks.

- A suite of bills and funding packages encouraging the development of thermal energy networks succeed in Connecticut, Maine, New York, Texas, and Washington. Additional bills are still under consideration in several states.

Keep reading for details on these highlights, and more.

Demonstrating the durability of decarbonization

Equipment Sales

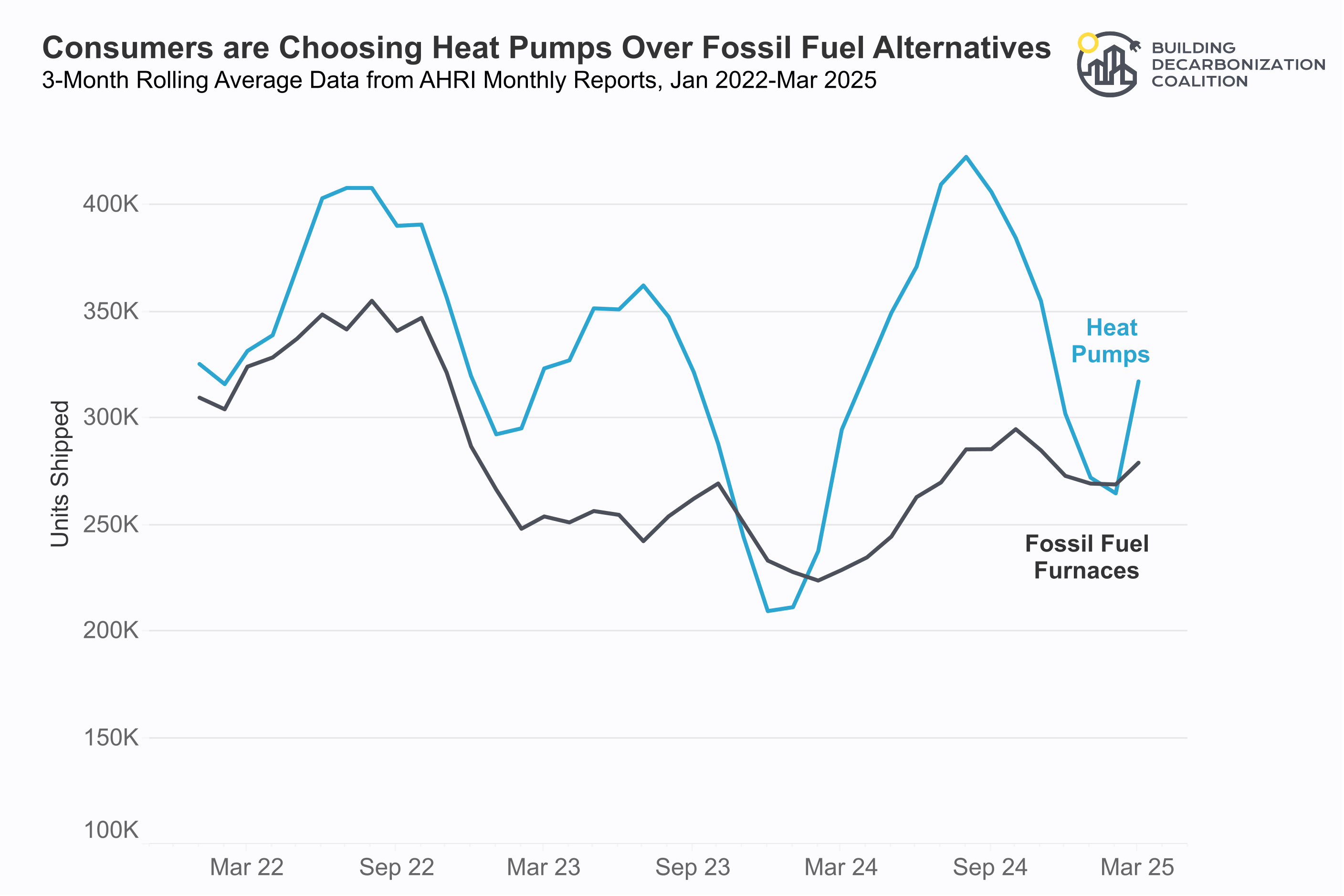

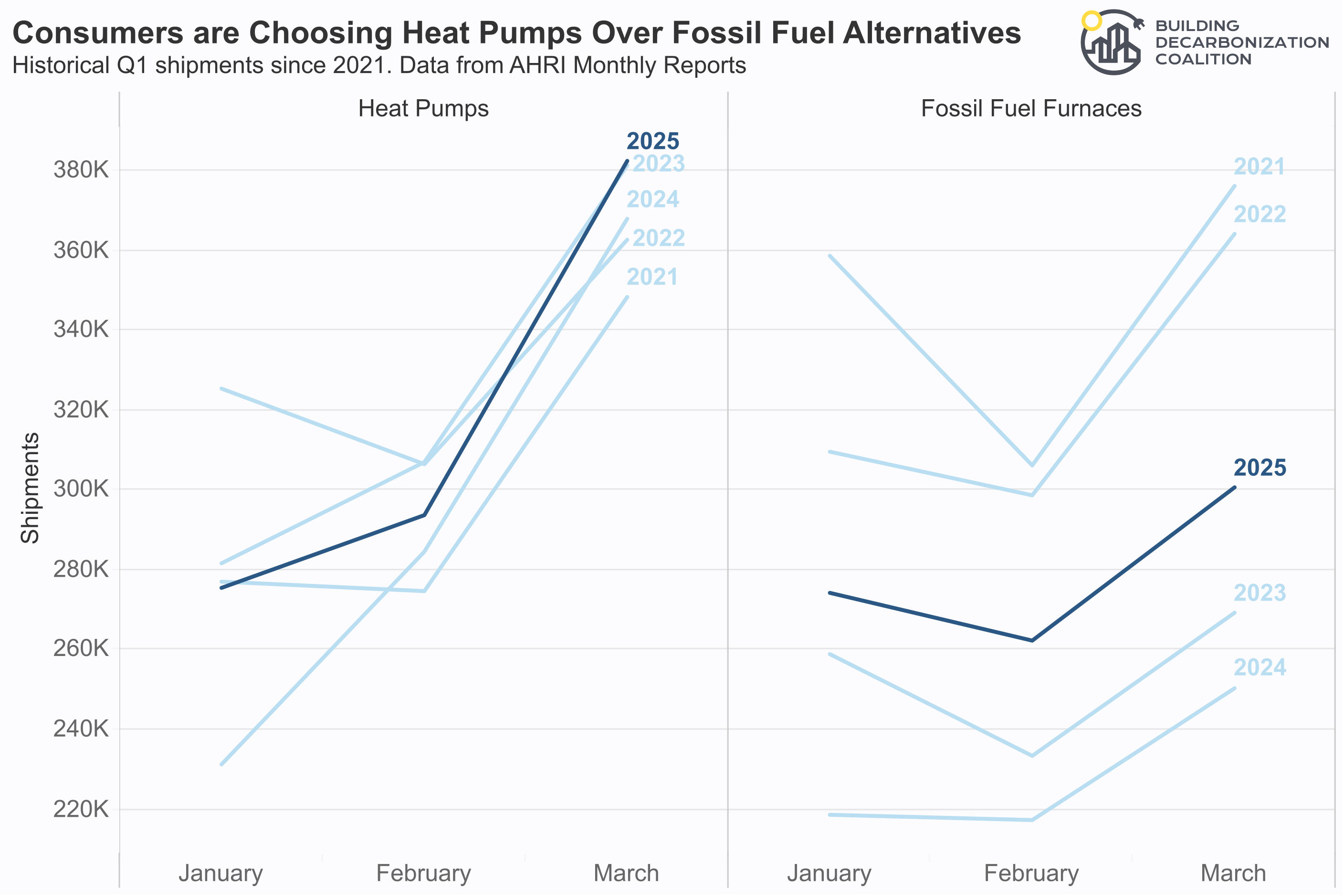

Last quarter we learned that the electric equipment market is more resilient and durable than the market for fossil fuel equipment. In the first few months of 2025, heat pump sales outpaced furnaces by 14%, according to shipment data from AHRI, continuing the steep upward trend from 2024.

Heat pumps continued strong performance in Q1 2025, roughly in line with the past several years. While fossil fuel furnace shipments improved compared to Q1 2024, they are still lower than their heat pump alternatives.

Heat pumps have outsold furnaces since around 2022, and the trend is continuing in early 2025 with heat pump shipments sharply ramping up compared to a relatively minimal uptick in furnace shipments to date. Peak shipments are historically during the summer months—we’ll check back next quarter to track progress as shipments continue to ramp up.

Regional Highlight

In the Northeast, heat pump sales have grown significantly in recent years, by as much as 400% from 2013-2021, according to a newly released market assessment developed by NEEP. The report includes market forecasts, an assessment of the program landscape, and installation cost findings for the Northeast region, including New England states and New York.

Scaling up building decarbonization, block by block

Our neighborhood-scale project map tracks projects across North America, ranging from fully decarbonized neighborhoods to early plans to transition from fossil fuels. This crowdsourced map is constantly being updated with new projects and we need your help to keep it current. Please submit neighborhood-scale projects for consideration here.

Note that all of the neighborhoods tracked here have been transitioned from a fossil fuel system to a non-emitting electric and/or thermal energy system. In other words, we are not tracking communities that were/are built electric from the start, of which there are many. This map demonstrates the momentum of decarbonizing existing neighborhoods, transitioning them from aging gas infrastructure onto clean energy infrastructure.

Projects

This quarter, we grew the neighborhood-scale project database by 19 projects (~20% more!). We uncovered exciting new projects under construction, including thermal energy networks at a zoo in Minnesota, a non-profit housing initiative in Canada, and the City Hall in Grand Marais, Minnesota. Key project characteristics are summarized in a dashboard, where users can easily filter the database, review project summaries, and view summary graphics.

See our full Neighborhood Scale Map on our webpage for additional information and functionality.

Project Highlight: Santa Rosa Junior College

David Liebman, Energy & Sustainability Manager at Santa Rosa Junior College, takes visitors behind-the-scenes at the College’s new Quinn Central Plant, which uses specialized heat recovery chillers and an electric boiler to heat and cool six campus buildings plus a 50-meter swimming pool. The color-coded pipes are intentional: the Central Plant is a center of learning for students and visitors alike.

Santa Rosa Junior College (SRJC) in Sonoma County, California is committed to making its campus resilient to increasing temperatures. Thanks to Sonoma County voters, who passed the Measure H bond in 2014, it has been able to fund a campus thermal energy network, solar arrays, and other sustainable building improvements. After first retrofitting Bertolini Hall with ground-source heat pumps, SRJC is now adding more buildings to its geothermal well field’s additional capacity; connecting the buildings via a thermal energy network proved more cost-effective than drilling separate geothermal boreholes for each building. Measure H also allowed the campus to replace its former cogeneration plant with an efficient central plant system that includes heat recovery chillers and an electric boiler to serve six additional buildings and a 50-meter pool. The college saved money by coordinating these projects with additional necessary upgrades, such as completing all geothermal drilling while the campus track was being resurfaced.

Enabling an equitable, managed transition off the methane gas system

The Future of Gas is an evolving policy framework that designates a set of questions, assumptions, and arguments associated with the long term sustainability of the methane gas system. The phrase has been used explicitly by researchers, state energy offices, legislators, and utility regulators to describe policies, reports, and proceedings since at least 2019. It has also been applied retroactively by advocates to demonstrate the growing trend of regulators and legislators who are critically examining the longevity of the gas system.

Within this section we highlight trends in gas utility rate cases, changes in accelerated pipeline replacement programs, and activity in Future of Gas proceedings. Together they indicate increased regulatory scrutiny over the continued investment in the GhG-emitting gas system and the opportunities to pivot this investment to clean energy alternatives like electrification and thermal energy networks.

Future of Gas Proceedings

Since 2020, fourteen “Future of Gas” regulatory proceedings (including a brand new proceeding in Maine) have led to key insights on the inequitable distribution of methane pollution, the risks of business-as-usual gas system growth, and the urgency of reforming outdated policies. A managed, neighborhood-scale transition off the gas system requires clear decarbonization targets to halt expansion, limit reinvestment, and right-size the system.

For a comprehensive list of Future of Gas proceedings, including closed and inactive dockets, see BDC’s public tracker.

Since 2020, 14 proceedings that we consider to address aspects of the “future of gas” have been opened across 12 states and D.C. Maryland is likely to open one in the near future, which would bring the total to 15. Currently, 10 are active, though not all have had recent activity.

Q2 FOG Proceeding Activity

|

State |

Recent Activity |

|

California Order Instituting Rulemaking to Establish Policies, Processes, and Rules to Ensure Safe and Reliable Gas Systems in California and Perform Long-Term Gas System Planning (R. 24-09-012) (Part 2, 2024-present under 24-09-012) (Part 1, 2020-2024 under R.20-01-007) |

In September 2024, California opened a new rulemaking to continue the work of its previous long-term gas planning proceeding (“Future of Gas Part 1” or R20-01-007) while also adjusting the scope to address new issues and perspectives that had taken shape since 2020 when the initial proceeding opened. The key objectives of the new rulemaking (which we will call the “Future of Gas Part 2” or 24-09-012) are to develop approaches and methodologies to aid in the long-term transition from the gas system to clean energy infrastructure and to determine interim actions to facilitate near-term decarbonization. Also included in the rulemaking are actions related to the implementation of SB 1221 (Min, 2024), which enables utilities to implement neighborhood-scale decarbonization pilots. Specifically, the law requires gas utilities to provide maps of planned gas projects and designate priority decarbonization zones. The CPUC will establish a voluntary program in 2026 through which gas utilities can apply for up to 30 pilot projects. The bill modifies the “obligation to serve” law by allowing utilities to reduce the consent threshold from 100% to no less than 67%, subject to CPUC approval. The proposed phasing of these issues is:

Q2:

|

|

D.C. In the Matter of the Implementation of Electric and Natural Gas Climate Change Proposals (Docket # 1167) (2020-present) |

In response to Order No. 22313 (Oct 10, 2024) directing utilities to file revised 15-year Climate Solutions and Climate Business plans, advocate intervenors suggested requiring Integrated Distribution System Planning (“IDSP”); under an IDSP, instead of each utility creating a separate plan, they would develop coherent, coordinated plans following a unifying framework and set of assumptions, as has been established in MA, MD, NY, and IL. Intervenors suggested opening a separate docket focused on electrical distribution planning and another docket for gas to focus on clean energy and non-gas-pipeline alternatives to gas infrastructure. These separate dockets would address an additional concern expressed by stakeholders–namely that Formal Case No. 1167 is “overly broad” and therefore limits meaningful stakeholder feedback. Responding to these and other suggestions and concerns, the Commission decided to open a new docket for IDSP (Formal Case No. 1182) and is seeking input from stakeholders on establishing a new future of gas proceeding. (Order No. 22339). Q2:

|

|

Illinois The Future of Natural Gas and issues associated with decarbonization of the gas distribution system (Docket # 24-0158) (2024-present) |

In March 2024, the ICC initiated a statewide Future of Gas proceeding to deliberate Illinois gas utilities’ future infrastructure investments. The Future of Gas proceeding will evaluate the impacts of Illinois’ current decarbonization and electrification goals on the methane gas system. Q2:

|

|

NEW: Inquiry Regarding Future of Natural Gas (Case No. 2025-00145) (May 2025-present) |

The Maine Public Utilities Commission has initiated a new Future of Gas proceeding to ”explore the implications of the State’s decarbonization goals for natural gas utilities and their customers and solicit information from stakeholders” (Notice of Inquiry). The MPUC cites the 12+ Future of Gas proceedings in other states as well as the need to align state regulation with GHG emissions goals as the motivations for opening a proceeding in Maine. The goals of the proceeding are to:

Initial requests for comment on questions to help determine the inquiry’s scope were due on June 17, 2025. Comments from gas utilities tended to focus on the promise of RNG and hydrogen. Several organizations, including the Maine Labor Climate Council, the Office of the Public Advocate and the Governor’s Energy Office, supported the exploration of thermal energy networks as NPAs. Maine Natural Gas Corp. also said they were open to considering TENs, but not as a primary strategy. |

|

Maryland New petition for proceeding filed, Case No. 9707 (First petition filed in Feb. 2023; new petition in May 2025) Order by Commission issued in response to petition. (Order 91683) |

In February 2023, Maryland’s Office of People’s Counsel (OPC) petitioned the PSC to open a Future of Gas proceeding to address “the planning, practices, and future operations of the gas public service companies to ensure they are consistent with the “interest of the public” and that the rates they charge utility customers are and continue to be “just and reasonable.” (Pg. 7). Following public comments in 2024, the PUC has been considering whether to formally initiate a future of gas proceeding to address gas system subsidies and non-gas-pipeline alternatives, among other issues. Q2:

|

|

Massachusetts The Future of Gas (Docket #: 20-80) (2020-present) |

In 2024, the Dept. of Public Utilities (DPU) directed its attention to examining existing gas line extension policies (LEAs), directing gas utilities to report on their LEA practices by August 2024. The revised policy proposes that new gas customers pay the full cost of connection to the gas distribution system, with few exceptions, and that “no costs associated with a new service or line extension shall be deemed prudently incurred and, thus, eligible for inclusion in an LDC’s rate base.” (Feb. 5, 2025 Memorandum). Q2: LEA Policy Updates:

The DPU will review and respond to comments in the coming months. |

|

Minnesota In the Matter of a Commission Evaluation of Changes to the Natural Gas Utility Regulatory and Policy Structures to Meet State Greenhouse Gas Reduction Goals (Docket #: G-999/CI-21-565)(2021-present) |

In January 2025, the Commission issued an updated scope and timeline to return to the state’s Future of Gas proceeding. In the coming months, the Commission intends to hold planning meetings to better understand issues related to the future of gas in Minnesota. Topics in these meetings to include: 1. Gas utility winter readiness 2. Renewable natural gas 3. Rate design to support hybrid heating 4. Alternative fuels (e.g. hydrogen) 5. an update on progress via the Commission’s thermal energy network work group. In parallel, the Commission intends to open two comment periods to consider changes to line extension allowance policy and rate design considerations to align with electrification and state emissions reduction goals. Q2: The PUC is soliciting comments on whether it should modify existing gas LEAs. The initial comment period for line extension allowances will close on July 8, 2025 and reply comments are due August 8th. It’s expected that the consideration of rate design will not be visited until the LEA period concludes later this year. |

|

New York Proceeding on Motion of the Commission in Regard to Gas Planning Procedures (Docket # 20-G-0131)(2020-present) |

The NY gas planning docket (20-G-0131) has evolved since its original impetus to address gas moratoria; as such, the NY PSC opened separate dockets for each utility’s cyclical long-term gas planning process. Gas utilities in NYS are required to make filings with proposed long-term gas plans (LTGP) every three years. The filings must include at least one scenario with no new traditional gas infrastructure and quantify the impact of these plans on greenhouse gas emissions, and provide regular updates to these plans. In Q1 2025, utilities submitted their new LTGPs. Q2:

|

Gas System Costs: Rates and Pipeline Replacement Programs

While Future of Gas proceedings typically unfold across several years and serve as a comprehensive space for regulators to plan for a managed transition off the gas system, rate cases are beginning to serve as a shorter term opportunity for intervention into aspects of gas utility planning that have profound effects on building decarbonization. These common, and sometimes frequent, quasi-judicial “cases” provide a space for public utility commissions to review and evaluate utility spending and have recently become a platform for deliberating fossil fuel subsidies like line extension allowances as well as electrification alternatives to new gas system spending (often called “non-pipeline alternatives” or NPAs).

Below we highlight an example of how some commissions and consumer advocates are treating rate cases as a venue to deliberate the future of the gas system, one rate case filing at a time.

Rate Case Spotlight:

Avista Corporation, Oregon (Docket No. UG 519)

Overview: Avista, a gas utility serving a little over 100K customers in Oregon, became the first gas-only utility in the state required to study and implement a neighborhood-scale electrification pilot, making it the second gas-only utility in the nation to do so (following Black Hills Energy in Colorado).

In this general rate case, Avista sought a $7.8 million rate increase, but was ultimately approved for nearly half of that request—increasing rates by $4.2 million and thereby disallowing $3.6 million rate hikes. The Oregon PUC approved a return on equity (ROE) of 9.5%, which is slightly below national average (which according to S&P Global was 9.73% in 2024) and below the company’s requested 10.4% ROE.

The rate increase will go into effect September 1, 2025 and the average residential customer will see a $1.36 or 2% monthly increase on their bill. A primary driver cited by the utility for the rate increase was the utility’s capital investments in the gas system, especially its accelerated pipeline replacement program, which sought to replace portions of the leak-prone Aldyl-A pipe.

Additional Outcomes:

- Neighborhood-Scale Electrification: The gas-only utility will be required to study and implement a neighborhood-scale pilot. The study will determine “where capping and pruning (i.e., decommissioning and removal of identified sections of the system) may be an option for a targeted voluntary electrification (TVE) pilot as a cost-effective alternative to Aldyl-A pipeline replacement” (Final Order, 3). The study, due June 2026, must include a cost-benefit analysis that includes the avoided cost savings of pipeline replacement as well as the state’s Climate Protection Program. Following this study, the utility will be required to implement a neighborhood-scale electrification pilot beginning in 2027.

- Non-Pipeline Alternative Analysis (NPAs): The utility will be required to complete an NPA analysis on capital projects budgeted at $500,000 and higher (previously the threshold was $1 million or higher). In addition, the utility must complete this NPA analysis on two projects within 12 months of the decision, regardless of the project cost.

- Equity and Consumer Protections: Avista must have a third party evaluate low-income customer needs and make changes to how they alert customers of missed payments. The utility is also no longer allowed to charge customers for industry dues and climate litigation costs, a disallowance we are seeing in other rate cases across the U.S.

Accelerated Pipeline Replacement Programs

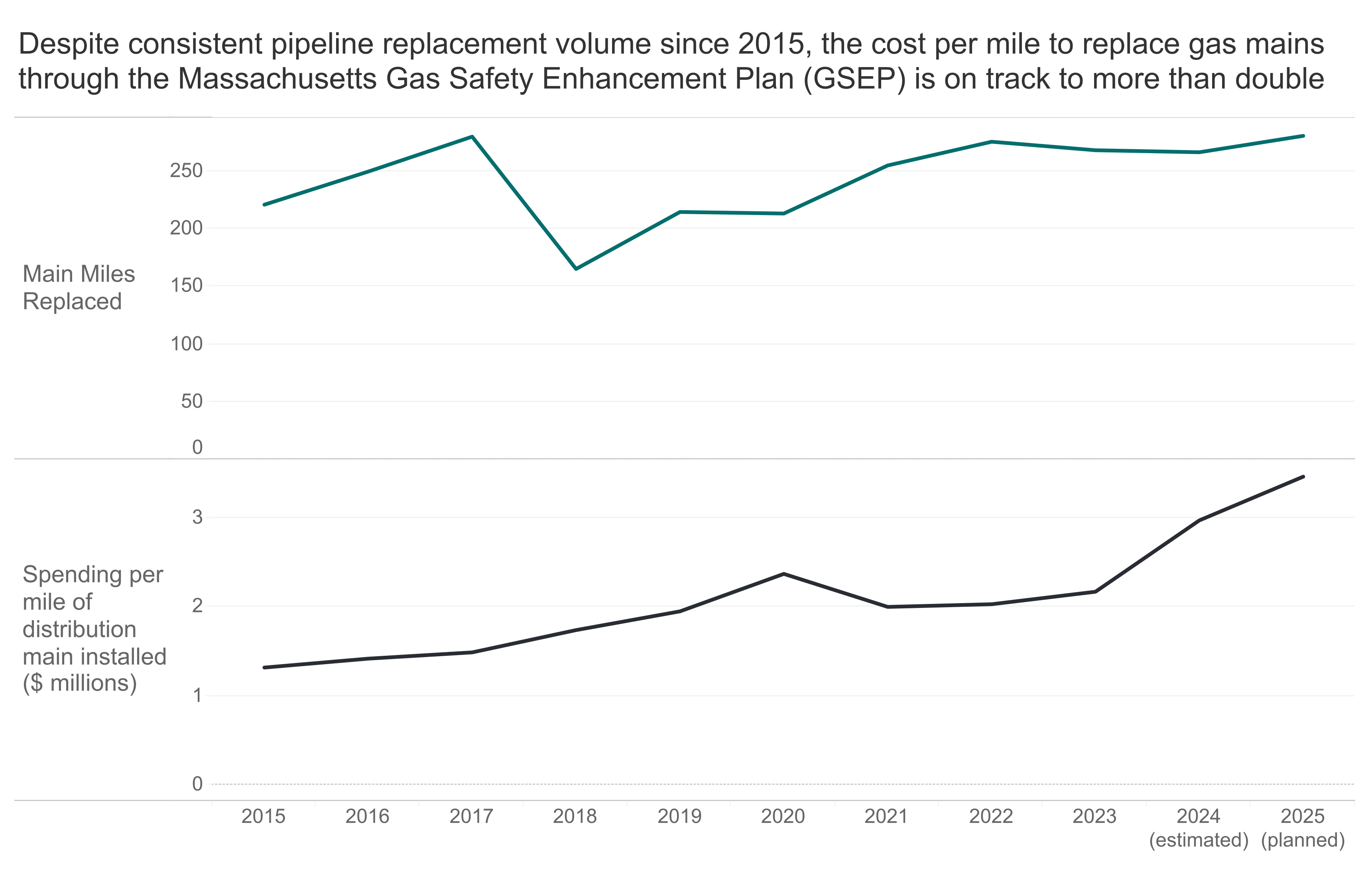

Last quarter we highlighted how gas system spending has drastically increased in recent years alongside “accelerated” pipeline replacement programs that frequently underperform, overspend, and do not always prioritize the most risky pipes for replacement.

This quarter we saw increased scrutiny of accelerated pipeline replacement programs from the Massachusetts DPU (GSEP), the Maryland Legislature (STRIDE), the District of Columbia Government (ProjectPIPES 2 & 3), as well as a timely critique from consumer advocates regarding how Peoples Gas is carrying out their risk assessment for the SMP program following last quarter’s order from the Illinois Commerce Commission.

The graphic below demonstrates the underperformance and ballooning costs of Massachusetts’s pipeline replacement program, based on a recent filing in D.P.U.-GSEP-03 that describes escalating spend per mile of distribution main installed from 2015-2024.

Data source: D.P.U. 24-GSEP-03, “Petition of Boston Gas Company d/b/a National Grid for Approval of its 2025 Gas System Enhancement Plan, pursuant to G.L. c. 164, § 145, for rates effective May 1, 2025,” filed April 30, 2025. (Tables 1 and 2 at pages 30 and 32).

Data source: D.P.U. 24-GSEP-03, “Petition of Boston Gas Company d/b/a National Grid for Approval of its 2025 Gas System Enhancement Plan, pursuant to G.L. c. 164, § 145, for rates effective May 1, 2025,” filed April 30, 2025. (Tables 1 and 2 at pages 30 and 32).

Q2 Activity on Pipeline Replacement Programs

|

Illinois People’s Gas System Modernization program |

In 2023, The ICC paused the SMP to investigate the underperforming and over-budget pipeline replacement program. The investigation found that Peoples Gas did not adequately prioritize high-risk pipeline and over-spent on less essential pipeline replacement. The final order issued on February 20, 2025 in Docket No. 24-0081 rejected each of the company’s proposed pathways and instead directed them to target the retirement (and replacement) of the remaining high-risk 1,112 miles cast iron and ductile iron pipes by 2035 (or approx. 111/miles a year–a pace more than double what the utility has been achieving in recent years). No expenditures were approved or denied as a part of the investigation. Q2:

|

|

Washington, DC: Washington Gas and Light’s ProjectPIPES Program Formal Case No. 1154: In the Matter of the Application of Washington Gas Light Company for Approval of PROJECTpipes 2 Plan Formal Case No. 1179: In the Matter of the Investigation Into Washington Gas Light Company’s Strategically Targeted Pipe Replacement Program |

On December 22, 2022, WGL filed its PIPES 3 proposal, a five-year program that was estimated to cost $671.8 million. In June 2024, the DC PSC dismissed the plan and directed WGL to submit a revised plan that better aligned with the District’s climate objectives and focused on high-risk pipe replacements. WGL resubmitted their plan, now called the “Strategic Accelerated Facility Enhancement” or SAFE Plan in September 2024. The new plan proposed spending $215 million over three years to replace 12.4 miles of main and 3,608 services. The OPC and other advocates urged the Commission to reject the proposal given that it did not adhere to the requirements of the recent Order, such as exploring NPAs like electrification and addressing what to do about stranded assets. The Commission did not dismiss or approve WGL’s new plan, but instead extended the current ProjectPIPES2 surcharge through the end of 2025 with a $34M spending cap. Q2:

|

|

Maryland: Strategic Infrastructure Development and Enhancement Plan (STRIDE) |

The 2013 Strategic Infrastructure Development and Enhancement Plan (STRIDE) sanctions a ratepayer surcharge to fund accelerated gas pipeline replacements. Advocates argue that STRIDE has shifted the risks of utility overspending to customers and increased customer rates significantly since gas utilities have implemented gas pipeline replacement programs, many of which have not achieved what they promised to at the outset. The Office of Peoples’ Counsel (OPC) estimates that gas utilities have spent more than two billion dollars on new gas infrastructure through this program and will spend close to 10 billion if the program proceeds to completion. Q2:

|

|

Massachusetts Gas Safety Enhancement Plan (GSEP) Docket # 24-GSEP-01-06 |

The Gas System Enhancement Plan (GSEP) was initiated through the 2014 Gas Leaks Act to replace leak-prone gas pipe (LPP) with new gas pipe, which was enabled through accelerated cost recovery that takes the form of surcharges on customer bills. Advocates have pointed to the inefficiency and ineffectiveness of the program for many years–esentially claiming that it has been used as a blunt instrument to facilitate widespread gas system upgrades rather than a scalpel to remove and replace urgently problematic areas. Amendments have been made to the policy in the past decade, most recently through 2024 Climate Act to require the consideration of NPAs when evaluating gas pipeline replacements. Q2:

The changes to the GSEP program include:

|

Empowering communities, transitioning workers, and achieving our climate goals through clean energy infrastructure

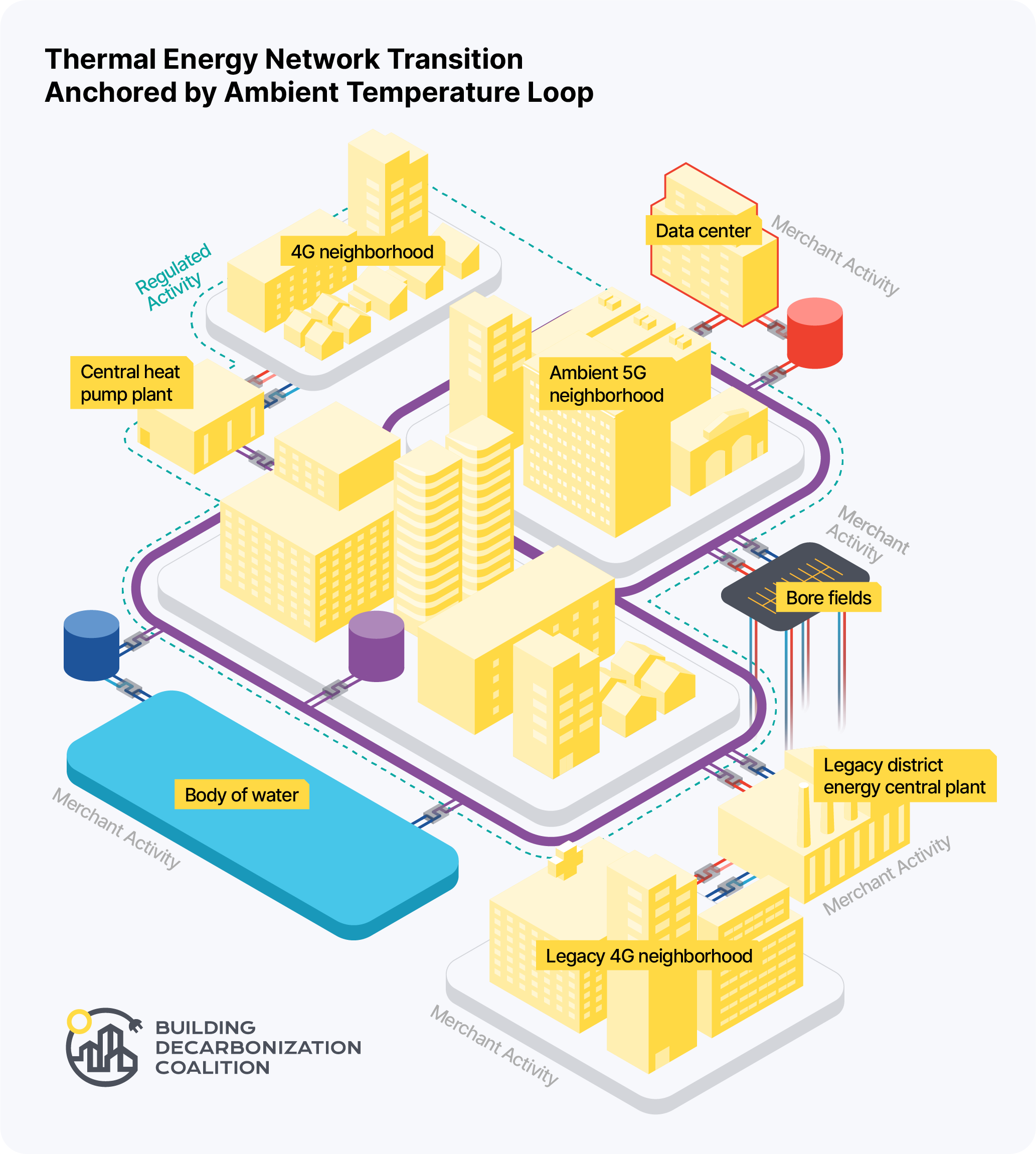

The future of heat represents the “solutions” side of the managed gas transition: the infrastructure, technologies, policies, and programs that we can build up while wind down the gas system. Synchronizing this transition will help achieve a thoughtful, equitable pathway for workers, utilities, ratepayers, and communities. We envision neighborhood- and community-scale solutions like thermal energy networks, pictured below, to be a key part of this transition.

Above: BDC’s recipe for scaling up decarbonization: start with an ambient-temperature thermal energy network as your base; attach heat sources, sinks, and storage like borefields, water bodies, and other buildings; and connect existing district heating systems and neighborhoods. Note: 4G and 5G indicate 4th and 5th generation thermal networks, as defined here.

Regulation

Q2 activity in proceedings and standards that are focused on implementing solutions to gas system expansion and emissions.

|

State / Rule or Regulation |

Recent Activity |

Category |

|

California, South Coast Air Quality Management District |

Following several months of revision and opposition, the South Coast AQMD board rejected staff amendments on Rules 1111 and 1121 which would have required 90% sales of zero emission water heaters and furnace replacements by 2036. Although it was rejected at the hearing, the board voted to send the rules back to the Stationary Sources Committee for further revision where it will likely be heard at the end of this year or early next year. |

zero-emissions appliances, air regulation |

|

California, Rulemaking Regarding Building Decarbonization (R. 19-01-011) |

The Building Decarbonization Rulemaking was opened in 2019 following the passage of SB 1477, which provided funding via the GHG emissions cap-and-trade program for two building electrification pilot programs: the Building Initiative for Low-Emissions Development (BUILD) Program and the Technology and Equipment for Clean Heating (TECH) Initiative. Q2: Stakeholders submitted comments responding to the Commission’s proposed decision regarding Phase 4 Track A (read our summary here). In initial comments, clean energy and environmental advocates proposed several revisions to the proposed decision, including:

Comments from the state’s IOUs largely coalesced around the following recommendations:

|

line extension allowances, rebates and incentives |

|

California, OIR to Investigate and Design Clean Energy Financing Options for Electricity and Natural Gas Customers |

Rulemaking 20-08-022 was instituted in 2020 to evaluate the potential efficiencies of offering financing strategies that allow for larger or broader investments in multiple types of clean energy improvements. In 2023, the CPUC directed utilities to propose expanded tariff-on-bill (TOB) financing programs, sometimes called Inclusive Utility Investment (IUI), which essentially allow a ratepayer to incrementally pay the utility back for a new piece of equipment (like a heat pump) via their monthly bill rather than having to advance the entire cost up-front. The mechanism is designed to have the high efficiency of the equipment offset the incremental costs on each monthly utility bill. TOB programs typically seek to make clean energy retrofits more accessible to lower-income households, though the concept of paying for a new appliance through a utility bill charge has been around for more than a century. The Investor-Owned Utilities (IOUs) submitted a joint TOB proposal in 2024, which was evaluated by a third party. Q2:

Possible as soon as Q3, the Commission will decide whether to authorize the pilots. |

inclusive utility investment, tariff-on-bill, clean energy financing, equity |

|

Colorado, Black Hills Clean Heat Plan (23A-0633G) |

A January 2025 Decision by Colorado’s Public Utility Commission marked the first time a gas-only utility has been directed to help customers electrify their homes and businesses, including pre-electrification weatherization and energy efficiency measures. The decision is the result of the state’s 2021 Clean Heat Plans (SB21-264), a law that directs gas utilities to develop plans to reduce the greenhouse gas emissions. Q2:

|

clean heat standards, electrification |

|

Colorado, Community-Initiated Neighborhood Scale Pilots (25D-0183G) |

The Public Service Company of Colorado and the Colorado Energy Office submitted a petition to the Commission seeking approval of neighborhoods selected for participation in the community-initiated Neighborhood-Scale Decarbonization (NSD) pilots, which was established by House Bill 24-1370. Q2:

|

neighborhood scale, thermal energy networks, electrification |

|

Massachusetts Seasonal Heat Pump Rate Inquiry (D.P.U. 25-08) |

On March, 21, 2025, the Massachusetts Dept. of Public Utilities (DPU) issued an order opening an inquiry into seasonal heat-pump rates following a petition from the Department of Energy Resources (DOER), which, in collaboration with other state agencies, formed an Interagency Rates Working Group (IRWG) to study challenges and opportunities for electric rates. While two major utility companies, Unitil and National Grid, already have newly-approved seasonal heat-pump rates, which will be implemented for the first time in the 2025-26 heating season, the DPU is now requiring Eversource Energy to propose a similar rate structure in time for the 2025-26 heating season. The DPU will further examine the IRWG’s recommendations for a more comprehensive heat-pump rate design to be implemented after the 2025-2026 heating season, inviting comments from all interested parties. Q2:

|

rates, heat pumps |

|

Maryland, Clean Heat Standard |

Maryland is developing a Clean Heat Standard (CHS) that will require that the thermal sector reduces emissions from heating delivery services and transitions to clean heating services and technologies, including installing zero-emission heating equipment (e.g. heat pumps), weatherizing buildings, and delivering cleaner fuels. Q2:

|

clean heat standards, electrification |

|

Maryland, Zero Emission Heating Equipment Standards (ZEHES) |

Following Gov. Moore’s 2024 Executive Order, the Maryland Dept. of Environment accepted stakeholder comments through early January on the proposed rule to address harmful NOx and GHG emissions through the phaseout of fossil fuel heating equipment. Q2:

|

zero-emissions appliances, NOx and GHG standards |

|

New York, Energy Efficiency and Building Electrification proceedings 14-M-0094: Proceeding on Motion of the Commission to Consider a Clean Energy Fund 18-M-0084: In the Matter of a Comprehensive Energy Efficiency Initiative 25-M-0248: In the Matter of the 2026-2030 non-Low- to Moderate-Income Energy Efficiency and Building Electrification Portfolio 25-M-0249: In the Matter of the 2026-2030 Low- to Moderate-Income Energy Efficiency and Building Electrification Portfolio |

The Energy Efficiency and Building Electrification proceeding formerly referred to as “New Efficiency: New York (NE:NY)” is the $5 billion program of ratepayer funded energy efficiency and electrification incentive programs. These program offerings were under regulatory review by the NYS Public Service Commission with the goal of improving the programs and spending for these programs. Q2: On May 15th, the New York Public Service Commission issued two orders and established two new proceedings (one specific to Low and Moderate-Income programs and the other for market rate programs) authorizing approximately $1 billion / year over the 2026 – 2030 periods for increased energy efficiency and clean energy solutions, including building electrification. Administered by the state’s large investor-owned electric and gas utilities and the New York State Energy Research and Development Authority (NYSERDA), nearly a third of this program funding ($1.57 billion) will be dedicated exclusively to low and moderate-income (LMI) programs. Details of the initiative include:

A joint statement from BDC and coalition partners on the EE/BE orders can be found here. |

energy efficiency, electrification, LMI programs |

|

New York, Utility Thermal Energy Network and Jobs Act (UTENJA) 22-M-0429 |

Since being directed by the 2022 UTENJA law, New York utilities have been exploring how they can use thermal energy networks to decarbonize entire neighborhoods in different communities across the state. There are currently 11 proposed pilot projects being considered by the Public Service Commission (PSC). Q2:

|

thermal energy networks, workforce, neighborhood scale |

Proposed bills that seek to develop, support, and enable clean energy alternatives to the gas system.

While many sessions came to a close by the start of summer, some (like MA, NJ, and CA) are still in session. Below are a selection of bills we found interesting and representative of the broader trends in building out the future of heat. We include updates on bills we highlighted last quarter, including those that did not pass.

Next quarter we will publish our annual building decarbonization legislative round-up to analyze and assess the successes and themes for this year’s state sessions.

Below are a few of the bills we’re watching this quarter:

|

State / Bill |

Description |

Categories |

|

California, The Heat Pump Access Act (SB 282) 🔴 Held |

Would have standardized permitting for heat pumps across the state, capped permit fees, and required a maximum of one permit for heat pump installations. |

permitting, electrification |

|

California, Local Electrification Planning Act (AB 39) 🟡 In Progress |

Requires local jurisdictions to adopt an electrification plan with climate strategies and goals to meet their communities’ energy needs. |

electrification; long-term planning |

|

Colorado, Building Decarbonization Measures (HB 25-1269) 🟢 Passed |

Reduces building emissions by expanding electrification and energy efficiency standards. |

energy efficiency; electrification codes |

|

Colorado, Utility On-Bill Repayment Program Financing (HB25-1268) 🔴 Held |

Would have required investor-owned utilities that serve more than 500,000 customers to establish or expand on-bill repayment programs to expand affordable access to efficient electric appliances and measures. |

ratepayer protections; affordability; financing |

|

Connecticut, An Act Concerning Energy Affordability, Access And Accountability (SB 4) 🟢 Passed |

Establishes a thermal energy network grant and loan program to support the development of TENs projects developed by utilities, local governments, tribes, academic institutions, and other entities. Implementation of the program is dependent on the appropriation of funds. |

thermal energy networks |

|

Illinois, Thermal Energy Networks and Jobs Act (HB 3609) 🔴 Held |

Would have allowed investor-owned utilities to pilot up to three thermal energy network demonstration projects in their territories; including at least one in an environmental justice community. In Q2 some of the bill language was included in an omnibus energy bill, which was also held. |

thermal energy networks; workforce; ratepayer protections |

| Maine, Resolve, to Establish a Commission to Study Pathways for Creating a Thermal Energy Networks Program in Maine (LD 1619)

🟢 Passed |

Creates a 13-member commission to evaluate whether Maine should develop TENs as part of its energy infrastructure. The commission will include 4 legislators, 6 appointed members of the public (including a labor representative, a member of an environmental organization, an expert in workforce development and construction, and others), and representatives from state agencies. The commission must assess technical feasibility, grid impact benefits, and funding opportunities, among other criteria. A final report is due December 3, 2025. |

thermal energy networks, study |

|

Maryland, Better Buildings Act 2025 (HB973/ SB804) 🔴 Held |

This bill would have required all newly constructed buildings to meet space and water heating needs without fossil fuels (A version of this bill was introduced last year and was also held). |

electrification; codes & ordinances |

|

Maryland, Next Generation Energy Act (HB 1035/SB937) 🟢 Passed |

One of two major energy bills signed into law this session, this aims to increase grid resiliency through battery storage, reduce data center cost shifting, and rein in utility bills by limiting gas system spending previously authorized through the 2013 law called the Strategic Infrastructure Development and Enhancement Plan (STRIDE), which sanctioned a ratepayer surcharge to fund accelerated gas pipeline replacements. Advocates have long argued that STRIDE has shifted the risks of utility overspending to customers and increased customer rates significantly since gas utilities have implemented gas pipeline replacement programs, many of which have not achieved what they promised to at the outset. The bill seeks to narrow this overly broad scope to focus on high-risk pipe while also requiring the evaluation of non-gas-pipeline alternatives. The following provisions of the Next Generation Energy Act will help reduce unnecessary gas system spending and redirect investments to non-gas-pipeline alternatives: 1. Requires gas pipeline spending under STRIDE and in multi-year rate plans prioritize safety and be cost effective (adopting provisions from the Ratepayer Protection Act (SB998/HB0419). 2. Directs the Maryland Public Service Commission (PSC) to reject multi-year rate hikes if they do not demonstrate “the customer benefit of the investment,” and prohibits utilities from seeking surcharges for overspending that have functioned as a profit guarantee. 3. Stops utilities from charging ratepayers for some trade association memberships (e.g. American Gas Association) and luxury perks like private jets (Adopting provisions from the Ratepayer Freedom Act (HB960). While the bill introduces much needed reform on the distribution side of the gas system, many advocates were disappointed to see that the bill also included provisions to fast-track the build out of gas plants on the generation side of the equation. |

NPAs, pipeline replacement, ratepayer protections, rates |

|

Massachusetts, An Act Relative to a Tactical Transition to Affordable, Clean Thermal Energy (SD.2249) 🟡 In Progress |

Builds on the state’s Future of Gas Docket (20-80) and last session’s climate law by redirecting gas pipeline replacement funds to non-gas-pipeline alternatives to new gas pipelines; removing ratepayer funded gas pipeline subsidies for new customers; and requiring gas and electric utilities sharing the same territory to develop joint tactical thermal transition plans. |

neighborhood scale; line extension allowances; integrated system planning; regulation |

|

Massachusetts, The Energy Affordability, Independence & Innovation Act (H.4144) 🟡 In Progress |

Filed by Governor Healey, the administration estimates that this bill will save Massachusetts customers approximately $10 billion over 10 years, on top of the $6 billion in savings estimated from her Energy Affordability Agenda announced in March. The bill’s reforms include reducing customer energy bills and ensuring utilities aren’t passing unnecessary costs onto ratepayers, in addition to other measures. |

affordability, ratepayer protections |

|

Minnesota, Data Center Bill (HF 16) 🟢 Passed |

While preserving the data center tax credit, the bill adds additional restrictions and water permit reviews for qualified large scale centers, protects strides towards 100% by 2040 and the RES, protects customers from shouldering infrastructure costs of new data centers but creating a separate customer class for them and other large energy users, and creates an avenue for a generous amount of weatherization and electrification funding for the state via annual fees on data centers relative to their scale. |

data center, ratepayer protections |

|

New Jersey, An Act Concerning State Energy Programs (A5516) 🟡 In Progress |

Directs BPU to establish incentive program for geothermal energy systems and grant program to support government energy aggregation program; increases annual target for new community solar projects. |

thermal energy networks, funding |

|

New York, Funding in State Budget for Thermal Energy Networks & Equitable Access to Clean Energy 🟢 Approved |

The FY 2026 New York State budget includes: A historic investment of $200 million for Thermal Energy Networks (TENs) at State University of New York and City University of New York campuses, as well as municipally-owned projects, which is the largest state investment in TENs in the nation. Added to the funding already allocated through the Bond Act ($150) and last year’s budget allocation of $30M for SUNY Albany’s campus-wide decarbonization project, this raises the state’s two-year investment in TEN infrastructure to $380M. A $50 million investment in the EmPower+ program, which will help more New Yorkers—especially low- and moderate-income households—access the benefits of clean energy and energy efficiency upgrades. |

thermal energy networks, neighborhood scale, funding, energy equity |

New York, NY HEAT Act* (S 4158/A4870A) *A core element of NY HEAT was passed through the stand-alone bill: An act to repeal the 100-foot rule line extension subsidy (S.8417/A.8888) 🟢 Passed |

Late in the NY legislative session, a central tenant of NY HEAT was introduced via a new bill that was solely focused on ending fossil fuel subsidies. The bill, which passed a day before the session ended, removes gas line extensions allowances (LEAs), a policy that adds new customers to the gas system for free while charging existing customers for this new infrastructure. A recent study by Synapse and NRDC found that these LEAs cost gas ratepayers $400M between 2022-2023. Combined with the existing All Electric Building Act, this law effectively puts an end to residential gas expansion in New York State. New York is unique in that the practice of providing “100 feet” of free line extensions for the gas system was dictated in the state’s public service law–not merely within individual utility tarriffs–making its removal much more difficult by requiring a legislative amendment. S.8417/A.8888 therefore amends section 31 of the NY public service law to specify that customers requesting new gas lines will be required “to pay material and installation costs relating to the pipe or other facilities to be installed to enable service to the applicant.” |

line extension allowances |

|

Oregon, Fair Energy Act (HB 3179) 🟢 Passed |

According to Oregon CUB, “HB 3179 empowers state regulators to help families avoid big increases in energy bills. This legislation limits how often utilities can ask for bill increases to every three years and eliminates winter rate hikes. Regulators also have more flexibility to consider economic impacts on customers.” |

affordability, ratepayer protections, rates |

|

Oregon, Relating to thermal energy networks; prescribing an effective date (SB 1143) 🔴 Failed |

Would have established a thermal energy network pilot program for utilities. |

thermal energy networks |

|

Texas, Relating to the projects that may be undertaken by a public improvement district, municipal utility district (HB 4370) 🟢 Passed |

Amends the Texas Local Government Code to designate geothermal infrastructure, including neighborhood-scale thermal energy networks, as Public Improvement Projects, which allows utility and non-utility entities (e.g. municipalities, water districts, and others) to own and operate geothermal infrastructure and to finance them through public bonds. |

thermal energy networks, local government |

|

Washington, Encouraging the Deployment of Low Carbon Thermal Energy Networks (HB 1514) 🟢 Passed |

Regulates Thermal Energy Companies (non-public utilities) greater than 5 customers / 250 residential end users. |

thermal energy networks; regulation |

Here are some topics and trends we will be watching for in the coming months:

- Market:

- In years past, EnergyStar has released its unit shipment data for the prior year in September. With this update, we’ll see how the heat pump water heater market has continued to grow. However, due to changes in federal priorities, which put the EnergyStar program at risk, we are not yet certain this data will be released.

- On the HVAC side, peak shipments are historically during the summer months—we’ll see how heat pumps fare compared to fossil fuel furnaces and one-way air conditioners according to AHRI data.

- Legislation: As states continue to wrap up their legislative sessions, we’re seeing several ongoing (e.g. thermal energy networks) and new (e.g. data center regulations) trends emerge in the building decarb space. BDC will be publishing a full analysis of this year’s building decarb legislative trends in September. Check out last year’s legislative wrap up for more insight into the trends we’ve been tracking.

- Rates: As of the end of Q2, there were 116 in-progress electric and gas rate cases that collectively represent over $24B in potential rate increases, according to S&P Global. We will be watching for pro-decarbonization outcomes, such as what occurred in the Avista rate case, in these pending cases.

- Regulation: We expect to see movement across several of the decarb trends we’re tracking at public utility commissions:

- Neighborhood-Scale Pilots: In California, on July 1st, investor-owned utilities submitted maps identifying a total of 5,000 miles of gas pipeline that could be targeted for decommissioning. On July 21st, they will also file their initial recommendations for priority decarbonization zones, which will overlay these maps. In Colorado, regulators just approved five community applications for Neighborhood-scale decarbonization pilots and will be moving forward with partnership agreements.

- Future of Gas proceedings: Maine, the latest state to open a Future of Gas proceeding, will continue to deliberate on the inquiry’s scope. We’re hoping the Maryland PSC officially opens a Future of Gas proceeding, following the renewed petition to do so by the Office of People’s Counsel.

- Line Extension Allowance Reforms: Minnesota’s PUC will receive comments on whether they should end gas line extension allowances and Maryland will consider a proposed reform of their LEA policies by end of year. Massachusetts’s DPU will also be reviewing stakeholder comments on LEA policies and responding to comments in the coming months. BDC will be releasing a policy brief on LEAs in Q3, which should serve as a resource for advocates looking to understand how to enable reform in their own states.