A quarterly update on the building decarbonization movement

Q3 | 2025

Authors

Kristin George Bagdanov, PhD, Senior Manager of Policy Research

Kevin Carbonnier, PhD, Senior Manager of Market Intelligence

About Our Research

BDC tracks and analyzes policies, trends, and data to accelerate the building decarbonization movement. We synthesize qualitative and quantitative data to produce rigorously researched, substantively contextualized, equitably cited, and endlessly shareable resources that help move our movement forward. We believe that research only becomes knowledge when it’s shared, so please pass along these resources to your communities and help us equitably decarbonize our buildings and neighborhoods. Read more about our research philosophy, resources, and reports.

Check out our Q2 | 2025 Momentum Report here.

Table of Contents

I. The Big Picture

II. Market Momentum

III. Neighborhood Scale

IV. Future of Gas

V. Future of Heat

VI. Looking Ahead

I. The Big Picture

What happened this quarter in the building decarbonization movement

This report offers a holistic view of the state-level policies and trends that work hand-in-hand with communities and market actors to stimulate and sustain the momentum toward decarbonization.

Here are a few signs of progress in the third quarter of 2025:

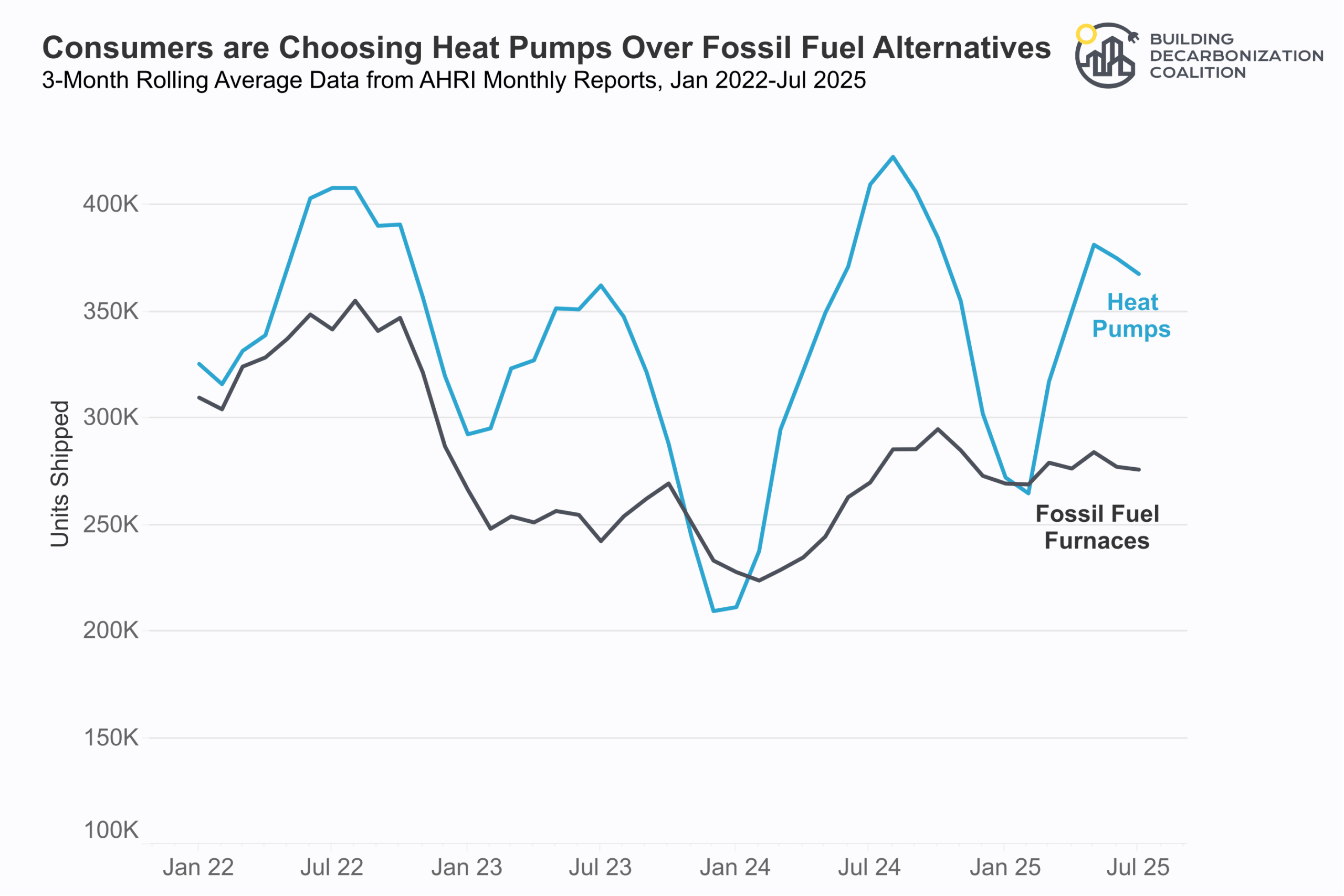

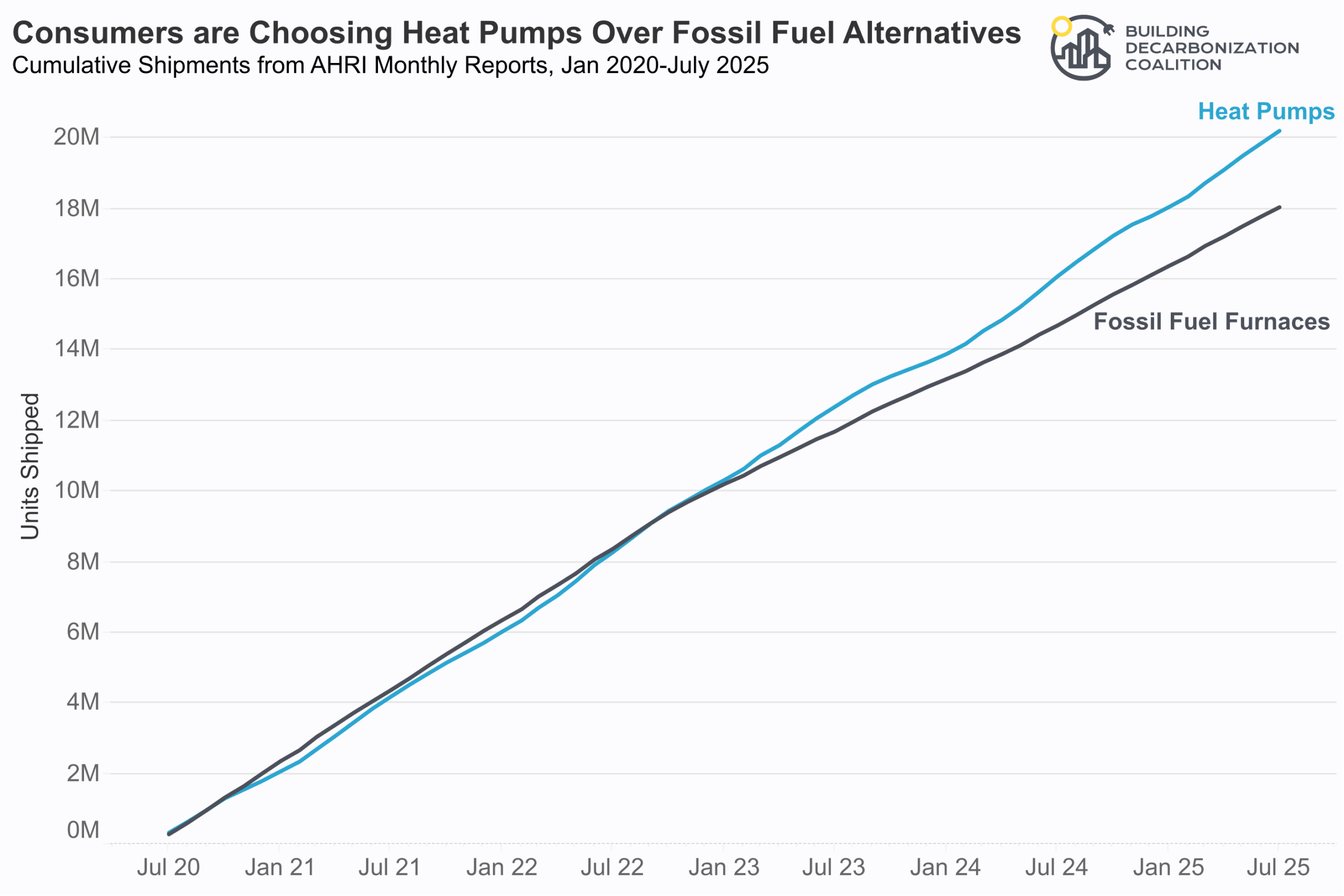

- So far in 2025, heat pumps have outsold fossil fuel furnaces by 26% (2.4M vs. 1.9M, through July), and have been widening the gap since they overtook furnace sales in 2022.

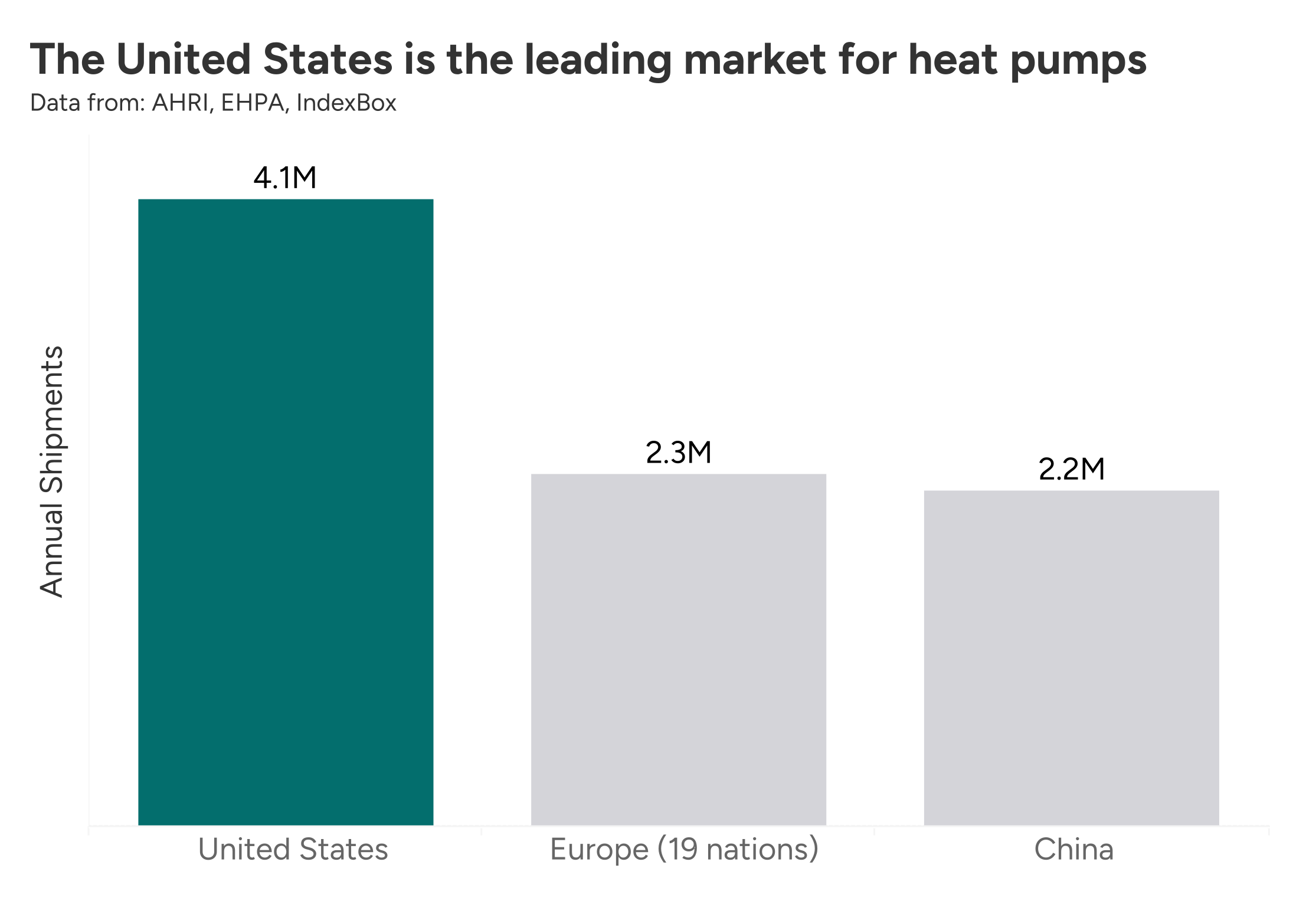

- The U.S. is installing nearly twice as many heat pumps as Europe and China: the U.S. installed 4.1M heat pumps in 2024, compared to Europe’s 2.3M and China’s 2.2M.

- Utility customers across the United States could save up to $7 billion annually if policymakers act now to reform gas line extension allowances, which are incentives for new customers to join the gas system.

- Starting Nov. 1, Massachusetts households that use heat pumps will be able to save an average of $540 this winter, as a new seasonal heat pump rate goes into effect for all three of the state’s electric utilities.

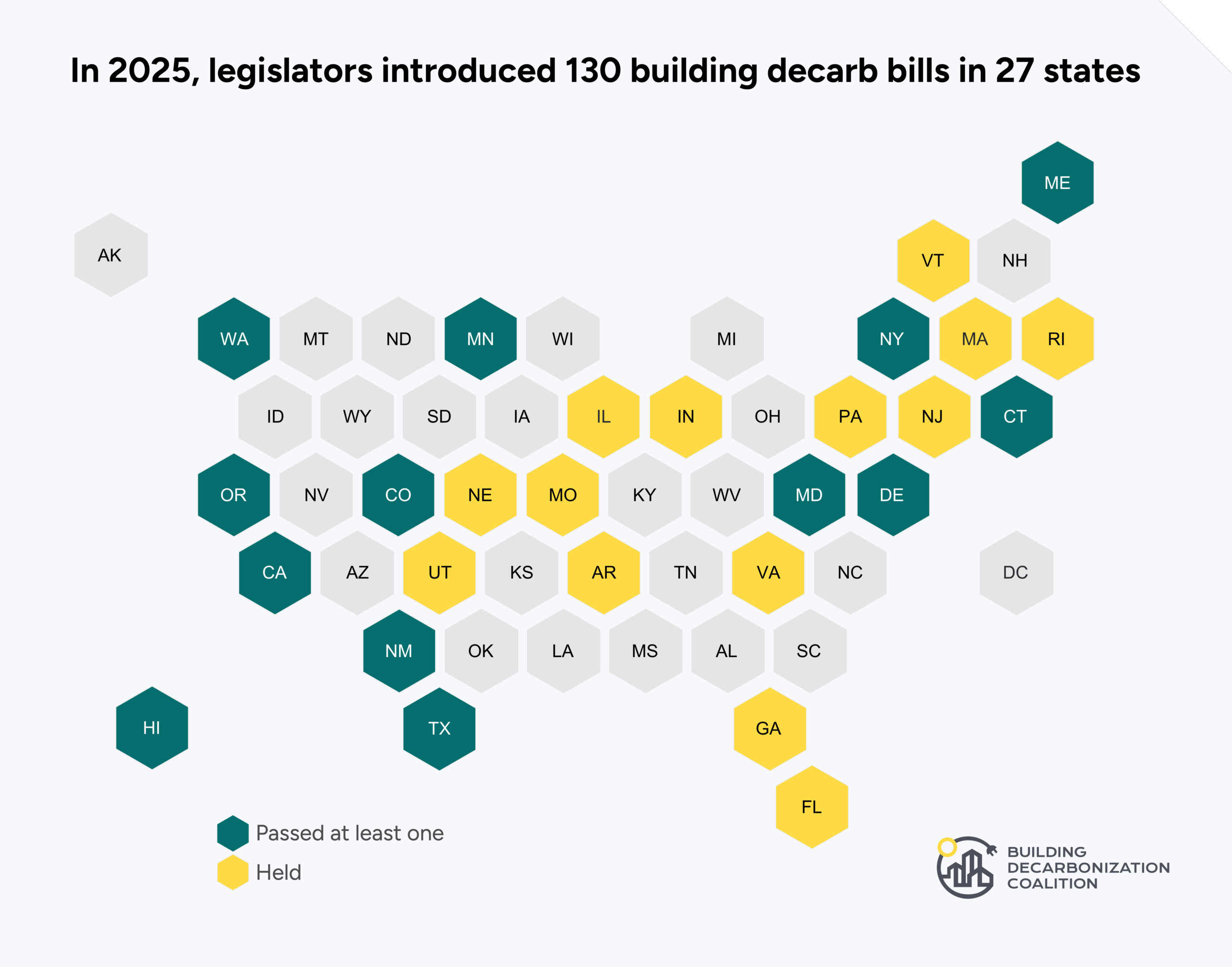

- 130 building decarbonization bills were introduced across the U.S. in the 2025 legislative session. Of those, 40 bills became law (nearly a third!).

- Twenty-six utility-led thermal energy network (TENs) pilots are now advancing across eight states: Colorado, Maryland, Massachusetts, Minnesota, New Jersey, New York, Washington and Illinois.

- A new study filed by engineering firm Buro Happold in New York’s utility-led thermal energy network pilot proceeding found that for the proposed pilots, “TENs resulted in higher cost savings over the modeled lifecycle when compared to ASHPs, with savings ranging from $8 million to $75 million depending on the size and composition of buildings in the system.”

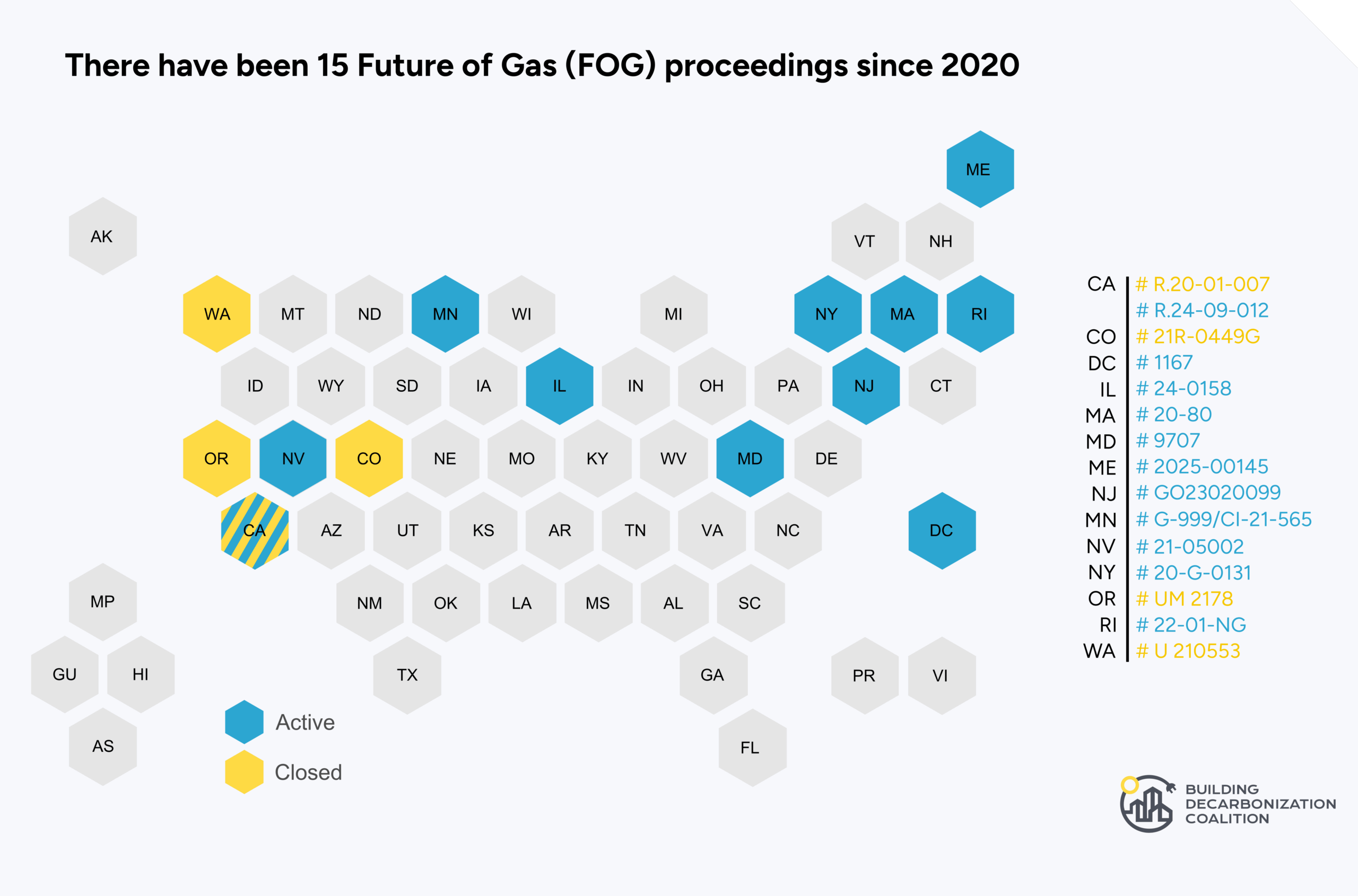

- A new Future of Gas Proceeding officially opened in Maryland, bringing the count to 15 Future of Gas proceedings since 2020.

Keep reading for details on these highlights and more.

Demonstrating the durability of decarbonization

Equipment Sales

The last several months are in line with the average over the past few years, with heat pumps maintaining higher market share over fossil fuel furnaces.

While heat pump shipments didn’t reach the record summer peak of 2024, they still showed strong sales momentum compared to fossil fuel furnaces. So far in 2025, heat pumps outsold fossil fuel furnaces by 26% (2.4M vs. 1.9M, through July), and have been widening the gap since they overtook furnace sales in 2022.

On the world stage, the U.S. is also outperforming Europe and China on heat pump deployment.

In 2024, the U.S. reported 4.1M heat pump shipments to distributors according to AHRI data (assumed to equal installations). Europe installed 2.3M in 2024, and 3M in both 2023 and 2022, according to the EHPA. China deployed 2.2M heat pumps in 2024, per IndexBox.

The Refrigerant Transition

Source: HARDI September 2025 Data Driven Newsletter

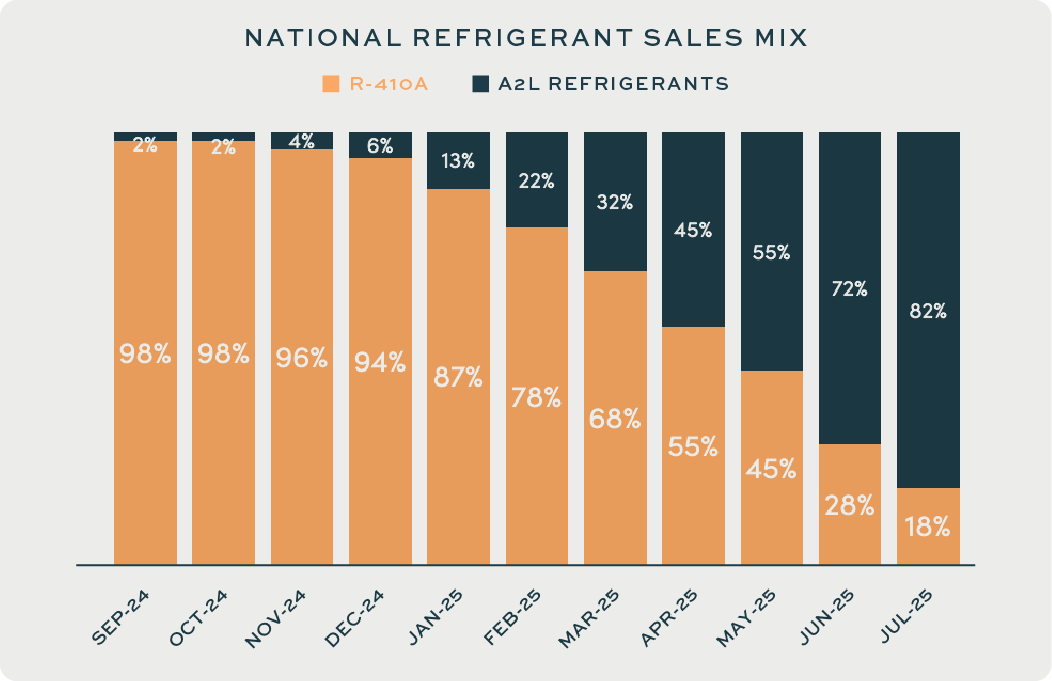

In the first seven months of 2025, distributor shipments of heat pumps with lower-GWP (global warming potential) refrigerants (A2Ls), has increased their market share by 69% compared to higher-GWP models, and is on track to fully transition the market by 2026. Given the potency of traditional refrigerants as a greenhouse gas and the growing global demand for cooling, it is imperative to limit its environmental impact by transitioning to lower-GWP alternatives, minimize leaks, and capture refrigerant from equipment at end-of-life.

This sea change is in response to the implementation of the AIM Act (American Innovation and Manufacturing Act, 42 U.S. Code section 7675), as heat pump manufacturers rise to the challenge to transition away from high-GWP (R-410A, commonly used in air conditioners, has a GWP of 2088) refrigerants in favor of lower-GWP alternatives, such as R-32 (with a GWP of 650) and R454B (with a GWP of 448). The AIM Act , enacted in 2020, mandates the phase down of the supply of HFCs (Hydrofluorocarbons) by 70% by 2029 and by 85% by 2036, and sets limits for the GWP of all new heat pumps to 700 starting January 2025.

Scaling up building decarbonization, block by block

Our neighborhood-scale project map tracks projects across North America, ranging from fully decarbonized neighborhoods to early plans to transition from fossil fuels. This crowdsourced map is constantly being updated with new projects and we need your help to keep it current. Please submit neighborhood-scale projects for consideration here.

Not included: It does not include all-electric neighborhoods that did not transition away from fossil fuels, or that are within communities with zero-emissions building standards. To learn where local and state governments are encouraging and requiring all-electric buildings, please visit our Zero Emissions Building Ordinance Tracker!

This map demonstrates the momentum of the work of decarbonizing existing neighborhoods, transitioning them from aging gas infrastructure onto clean energy infrastructure.

See our full Neighborhood Scale Map on our webpage for additional information and functionality.

Projects

Thermal Energy Network Utility Pilots

Twenty-six utility-led TENs pilots, also referred to as demonstration projects, are now advancing across eight states: Colorado, Maryland, Massachusetts, Minnesota, New Jersey, New York, Washington and Illinois. Eighteen gas and dual-fuel utilities are behind these projects. One pilot—Eversource Energy’s geothermal network in Framingham, Massachusetts—is already operational (it turned one year old this summer). National Grid’s geothermal network pilot in Boston is likely to break ground next.

These pilots join the many non-utility-led TENs already under construction or operational in cities and campuses nationwide. But what makes utility ownership exciting is its potential to scale. If pilots succeed in winning over customers, communities, lawmakers, and utility executives, we will see a regulatory paradigm shift in which gas utilities transition from distributing gas to distributing heat, including heat from geothermal sources.

For more insights, read BDC’s recent article on utility-led TENs pilots in The Driller, written by Ania Camargo Cortés and Jess Silber-Byrne.

Project Highlight: Whisper Valley, TX

An aerial view of Whisper Valley. Image credit: Ecosmart Solution.

While our neighborhood-scale project maps tracks the transformation of existing communities that have chosen electric options and thermal energy networks over gas, we wanted to share an exciting update on the Whisper Valley community outside of Austin, Texas, which was built as an energy-resilient community from the start with its own geothermal network called the GeoGrid™.

You can read our case study about this project here, and learn more about the story behind these stats:

- 800 homes are connected to the Whisper Valley geothermal network

- $60 is the average monthly fee to connect to the network

- There is a 50% cost reduction in installing geothermal per home, when done at the neighborhood-scale, compared to individual geothermal heat pumps

Enabling an equitable, managed transition off the methane gas system

The Future of Gas is an evolving policy framework that designates a set of questions, assumptions, and arguments associated with the long term sustainability of the methane gas system. The phrase has been used explicitly by researchers, state energy offices, legislators, and utility regulators to describe policies, reports, and proceedings since at least 2019. It has also been applied retroactively by advocates to demonstrate the growing trend of regulators and legislators who are critically examining the longevity of the gas system.

Within this section we highlight trends in gas utility rate cases, changes in accelerated pipeline replacement programs, reform activity for gas system subsidies and new action in Future of Gas proceedings. Taken together, this increased activity on right-sizing the gas system and its costs demonstrate the increased scrutiny over the continued investment in the GHG-emitting gas system and the opportunities to pivot this investment to clean energy alternatives like electrification and thermal energy networks.

Future of Gas Proceedings

Since 2020, 15 proceedings that we consider to address the “Future of Gas” have been opened across 13 states and D.C. Currently, 11 proceedings are active, including a newly opened proceeding in Maryland, though not all have had recent activity. These proceedings have led to key insights on the inequitable distribution of methane pollution, the risks of business-as-usual gas system growth, and the urgency of reforming outdated policies. A managed, neighborhood-scale transition off the gas system requires clear decarbonization targets to halt expansion, limit reinvestment, and right-size the system.

For a comprehensive list of Future of Gas proceedings, including closed and inactive dockets, see BDC’s public tracker.

This quarter’s FOG highlights:

- New Future of Gas proceeding: Maryland officially launches its Future of Gas proceeding, following two years of petitioning by the Office of People’s Counsel

- Line extension allowances are top of mind: Massachusetts has nearly crossed the finish line on eliminating gas line extension allowances through their FOG proceeding and Minnesota is currently in a comment period regarding its LEA policy

- CA utilities are the first to map neighborhood-scale pipeline replacement opportunities: As part of its Future of Gas proceeding, California utilities released maps of planned pipeline replacement projects over the next decade, per the requirements of the neighborhood-scale pilot law that passed in 2024

Q3 FOG Proceeding Activity

|

State |

Recent Activity |

|

California Order Instituting Rulemaking to Establish Policies, Processes, and Rules to Ensure Safe and Reliable Gas Systems in California and Perform Long-Term Gas System Planning (R. 24-09-012) (Part 2, 2024-present under 24-09-012) (Part 1, 2020-2024 under R.20-01-007) |

The key objectives of the new rulemaking (which we will call the “Future of Gas Part 2” or 24-09-012) are to develop approaches and methodologies to aid in the long-term transition from the gas system to clean energy infrastructure and to determine interim actions to facilitate near-term decarbonization. Also included in the rulemaking are actions related to the implementation of SB 1221 (Min, 2024), which enables utilities to implement neighborhood-scale decarbonization pilots. Specifically, the law requires gas utilities to provide maps of planned gas projects and designate priority decarbonization zones. The CPUC will establish a voluntary program in 2026 through which gas utilities can apply for up to 30 pilot projects. The bill modifies the “obligation to serve” law by allowing utilities to reduce the consent threshold from 100% to no less than 67%, subject to CPUC approval. The proposed phasing of these issues is:

Q3:

|

|

D.C. In the Matter of the Implementation of Electric and Natural Gas Climate Change Proposals (FC # 1167) (2020-present) Related docket on integrated system planning: FC #1182 |

The DC Public Service Commission (DCPSC) opened an investigatory proceeding (Docket # FC-1167) in 2020 following the merger of AltaGas and Washington Gas and Light Company (WGL) in 2018. The joint settlement submitted by both parties in the merger proceeding required that AltaGas and WGL file a climate business plan that demonstrated how they are advancing or meeting DC’s energy and climate goals. However, the business plans submitted in 2020 were deemed insufficient, prompting advocates to demand an evidentiary proceeding to better address the future of gas in DC. In addition, the mandate of the Commission had been recently modified by the 2018 CleanEnergy DC Omnibus act to uphold “the conservation of natural resources, and the preservation of environmental quality, including effects on global climate change and the District’s public climate commitments.” This broadened mandate combined with stakeholder intervention prompted the DCPSC to open another proceeding to continue the dialogue and ensure alignment between the utility and DC’s climate goals. Specifically, “the Commission opened Formal Case No. 1167 to commence a climate policy proceeding to consider whether and to what extent utility or energy companies under our purview are meeting and advancing the District’s energy and climate goals.” In response to Order No. 22313 (Oct 10, 2024) directing utilities to file revised 15-year Climate Solutions and Climate Business plans, advocate intervenors suggested requiring Integrated Distribution System Planning (“IDSP”). Under an IDSP, instead of each utility creating a separate plan, they would all develop coherent, coordinated plans following a unifying framework and set of assumptions, as has been established in MA, MD, NY, and IL. Intervenors suggested opening a separate docket focused on electrical distribution planning and another docket for gas to focus on clean energy and non-gas-pipeline alternatives to gas infrastructure. These separate dockets would address an additional concern expressed by stakeholders–namely that Formal Case No. 1167 is “overly broad” and therefore limits meaningful stakeholder feedback. Responding to these and other suggestions and concerns, the Commission decided to open a new docket for IDSP (Formal Case No. 1182) and is seeking input from stakeholders on establishing a new future of gas proceeding. (Order No. 22339). Q3: Integrated Distribution System Planning (Case 1182):

Future of Gas (Case 1167):

|

|

Illinois The Future of Natural Gas and issues associated with decarbonization of the gas distribution system (Docket # 24-0158) (2024-present) |

In March 2024, the ICC initiated a statewide Future of Gas proceeding to deliberate Illinois gas utilities’ future infrastructure investments. The Future of Gas proceeding will evaluate the impacts of Illinois’ current decarbonization and electrification goals on the methane gas system. Prior to the formal docketed proceedings, the staff convened two workshop series followed by staff reports. The first workshop series began in April 2024 and sought to “identify all relevant topics relating to the future of natural gas in Illinois and decarbonizing the State’s natural gas distribution systems.” The second phase commenced in August 2024 and will consist of three subphases: Phase 2A, Decarbonization pathway options and technologies; Phase 2B, Decarbonization Pathway Working Groups; Phase 2C, Identification of legislative and regulatory options related to Future of Gas issues. The Phase 2 report will be prepared between November 2025 and February 2026. Q3:

|

|

New: Case No. 9707 (First petition filed in Feb. 2023; second petition in May 2025; Order 91791 to open Future of Gas investigation within docket issued in August 2025)

|

In February 2023, Maryland’s Office of People’s Counsel (OPC) petitioned the PSC to open a Future of Gas proceeding to address “the planning, practices, and future operations of the gas public service companies to ensure they are consistent with the “interest of the public” and that the rates they charge utility customers are and continue to be “just and reasonable.” (Pg. 7). Following rounds of public comments in 2024 and another petition by the OPC in 2025, the PSC issued an order June 13, 2025 indicating it will seek to end gas line extension allowances for new gas connections. The PSC argued that the true cost of gas should be taken into account when evaluating these subsidies and that encouraging gas system expansion contradicts the state’s climate goals. The Commission directed staff to issue proposed regulations for gas LEAs by Dec. 1, 2025. Stakeholders will have the opportunity to respond via a rulemaking proceeding. Q3:

|

|

Massachusetts The Future of Gas (Docket #: 20-80) (2020-present) |

In its landmark December 2023 order in the “Future of Gas” docket, the MA DPU set the tone for a managed gas transition in line with the state’s climate goals of net-zero by 2050. In a nutshell, they argued that business-as-usual gas expansion, operations, and subsidies would be held to a new standard–namely that gas utilities would have the “burden of proof” to demonstrate the non-gas-pipeline alternatives were either not cost-effective or infeasible before proceeding with major gas system investments, such a whole pipeline replacements. This decision laid the groundwork to re-evaluate incentives to customers to join the gas system, who might be lured by the near-term benefits but stuck with longer term costs like stranded assets and increasing bills. In 2024, the Dept. of Public Utilities (DPU) directed its attention to examining existing gas line extension policies (LEAs), directing gas utilities to report on their LEA practices by August 2024. The revised policy proposes that new gas customers pay the full cost of connection to the gas distribution system, with few exceptions, and that “no costs associated with a new service or line extension shall be deemed prudently incurred and, thus, eligible for inclusion in an LDC’s rate base” (Feb. 5, 2025 Memorandum). Q3: Line Extension Allowances Interlocutory Order

Obligation to Serve (OTS)

|

|

Minnesota In the Matter of a Commission Evaluation of Changes to the Natural Gas Utility Regulatory and Policy Structures to Meet State Greenhouse Gas Reduction Goals (Docket #: G-999/CI-21-565)(2021-present) |

In 2021, the MN Legislature directed the Commission to initiate a proceeding to evaluate changes to natural gas utility regulatory and policy structures needed to meet or exceed Minnesota’s greenhouse gas emissions reduction goals. The PUC then opened The Future of Gas docket (G999/21-565). Initially the docket focused on gas utilities’ Integrated Resource Plans (IRPs), issuing orders on March 27 and October 28, 2024, in Docket No. G008,G002,G011/CI-23-117. In January 2025, the Commission issued an updated scope and timeline to return to the state’s Future of Gas proceeding, with a focus on the following topics: 1. Gas utility winter readiness 2. Renewable natural gas 3. Rate design to support hybrid heating 4. Alternative fuels (e.g. hydrogen) 5. an update on progress via the Commission’s thermal energy network work group. In parallel, the Commission has opened up a comment period to consider changes to line extension allowance policies and rate design issues. The comment period of the LEA policy reform closed on September 9, 2025 with an anticipated hearing and order at the end of year. It’s expected that the consideration of rate design will not be visited until late Q1 2026. Q3: Line Extension Allowances

Greenhouse Gas Costs

|

|

New York Proceeding on Motion of the Commission in Regard to Gas Planning Procedures (Docket # 20-G-0131)(2020-present) |

The NY gas planning docket (20-G-0131) has evolved since its original impetus to address gas moratoria; as such, the NY PSC opened separate dockets for each utility’s cyclical long-term gas planning process. Gas utilities in NYS are required to make filings with proposed long-term gas plans (LTGP) every three years. The filings must include at least one scenario with no new traditional gas infrastructure and quantify the impact of these plans on greenhouse gas emissions, and provide regular updates to these plans. In Q1 2025, utilities submitted their new LTGPs. In Q2, Utilities continued to submit updates to their LTGP and held technical conferences. Q3: 23-G-0676 (Central Hudson Gas & Electric): On July 17, 2025, the PSC filed an Order regarding the utility’s LTGP. The Order directed the utility to take steps to reduce the consumption of methane gas, propose pilot demand response programs, and develop non-pipeline alternatives for at least two areas. The order also includes reporting on customers who have switched to electrification for space heating as well as quantifying the benefits of their LTGP to disadvantaged communities. 23-G-0437 (New York State Electric & Gas Corporation and Rochester Gas and Electric): The utilities issued updates to their LTGP on May 22, 2025 and May 29, 2025. The updates included a Non-pipeline Alternative (NPA) strategy for replacing leak-prone pipe segments with full electrification. In Q3 they submitted their “Natural Gas Benefit-Cost Analysis Handbook” and an updated Residential Demand Response Proposal. 23-G-0147 (ConEd and Orange and Rockland Utilities): Orange and Rockland Utilities and ConEd submitted their annual update to their LTGP on May 15, 2025. Their report includes an analysis of different “levels of customer intervention” needed for building electrification based on the technical feasibility of converting different building types, as well as a proposed definition of “hard to electrify” customers. Since then, the City of New York has filed comments on the proposed gas demand response pilot. 24-G-0248 (National Grid): National Grid submitted a final draft of their LTGP on March 7, 2025 and submitted an Addendum to the LTGP in which it evaluated the potential benefits and costs of Northeast Supply Enhancement (NESE) to both Downstate NY gas customers and New York (Technical Conference Slides, July 28, 2025). The NESE Project is a significant transmission pipeline expansion that some stakeholders have described as “unnecessary and would burden New Yorkers with higher costs while undermining climate progress” (NRDC Comments, Sept. 8, 2025). Building decarb. advocates have questioned the evidence and intentions of National Grid’s LTGP and Addendum, noting that “Over the 15 months of this docket, National Grid’s goal and focus have shifted” and their LTGP did not align with the recommendations in the Climate Action Council’s Scoping Plan (Sierra Club Comments, September 5, 2025, pg 1). On Sept. 18, the Commission filed its Order on their LGTP. The Order included directives for the utility to improve its demand forecasting process; address concerns about reliability; and “provide a thorough update on their non-pipe alternative deployment efforts in their next long-term plan filing, including listing all solicitations and their results” (Order, pg. 139). The utility is also required to conduct a bill impact analysis in their next LGTP and include new reporting on customers who terminate their gas service. 22-G-0610 (National Fuel Gas Distribution Corp.): On June 6, 2025, the utility filed its annual report on its current LTGP. There has been no activity in this docket in Q3, though the utility will soon be due for their next LGTP, which is on a three-year cycle. |

Gas System Costs

Line Extension Allowances

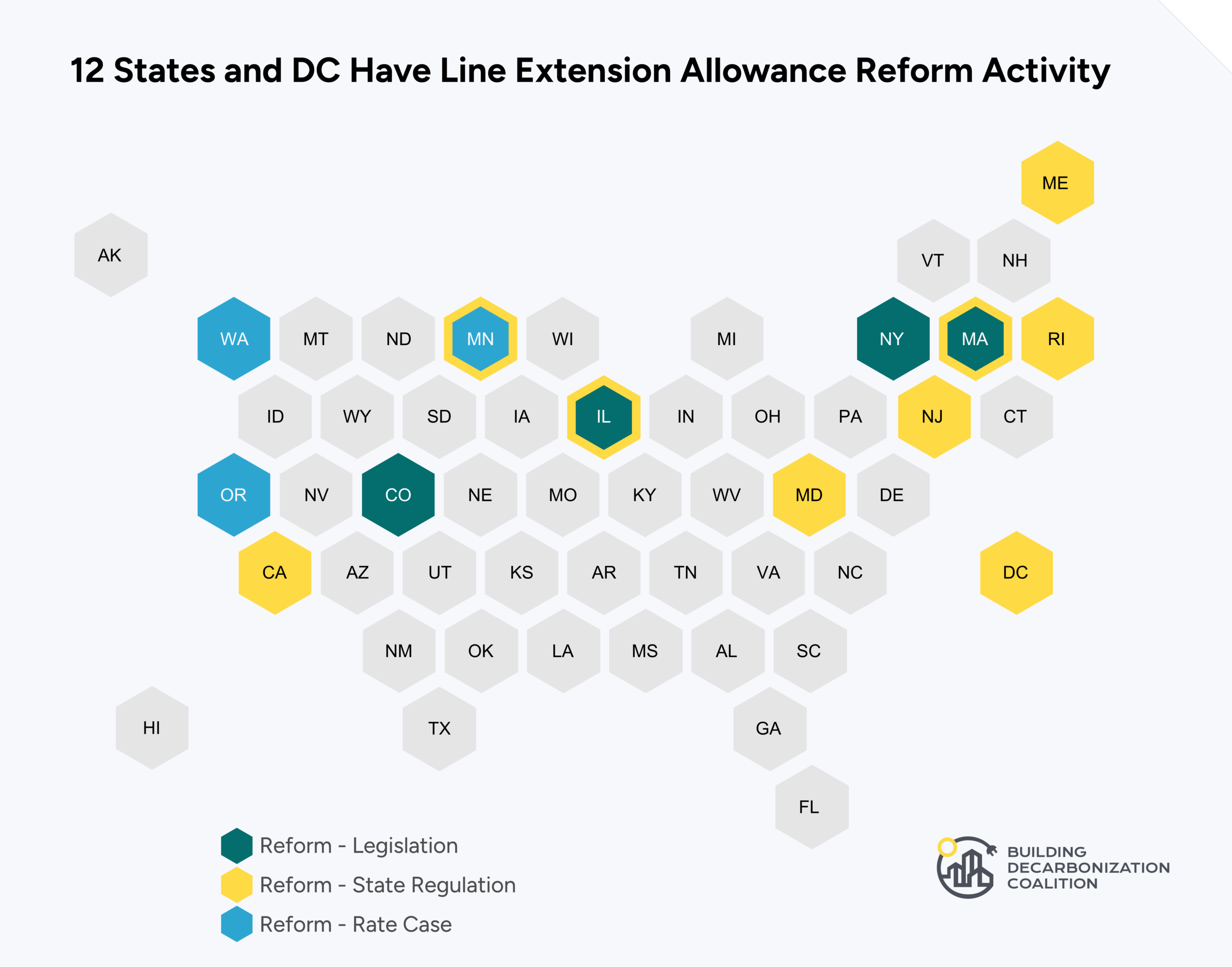

BDC’s recent report on Line Extension Allowances found that utility customers across the United States could save up to $7 billion annually if policymakers act now to reform gas line extension allowances (LEAs), which are subsidies that cover some or all of the costs associated with connecting a new building to the gas system.

Policymakers across the U.S. are seeing the advantages of this cost-saving reform, with six states having already made partial or full reform to these subsidies and six more states and D.C. actively considering removing gas LEAs.

Our new policy brief, The End of Gas System Subsidies: Why Gas Line Extension Allowances No Longer Serve Us, offers an overview of the current LEA landscape in the U.S. and recommendations for reforming outdated policies that promote the growth of gas consumption and emissions.

Rate Case Spotlight: National Grid, New York (24-G-0323)

Overview: In August 2025, the NY PSC approved three-year rate plans for National Grid, a dual fuel utility that provides electric and gas utility service to approximately 2.3 million customers in upstate New York. The utility initially requested to increase its electric delivery revenues by $525.5 million and its gas delivery revenues by $148 million, which would equate to monthly bill increases of $18.92 (15%) and $18.32 (20%), respectively (NYPSC Order, Aug. 14, 2025, 24-E-0322). While the NY PSC’s final order reduced the utility’s request for total electric delivery revenues by $340 million (67% less than requested) and reduced total gas delivery revenues by nearly $100 million (63% less than requested) in the first year, the impacts on energy bills will still be impactful, especially for households that are already energy burdened.

While disappointing to see continued rate hikes, this rate case is notable as, according to S&P Global, it is the first time that “New York utility regulators…formally ruled that the state’s legally binding climate goals applied to a gas utility rate case,” setting an important precedent as the PSC continues to direct utilities to develop emissions-reducing pathways, such as electrification and thermal energy networks. In this rate case, regulators directed National Grid to seriously pursue non-gas-pipeline alternatives like neighborhood-scale electrification and thermal energy networks; directed them to stop marketing gas as clean or promoting new gas connections; and launch NPA pilots for current leak-prone pipe segments.

Non-gas-pipeline Alternatives:

- Overview: Requires National Grid “to consider NPAs in lieu of leak-prone pipe (LPP) replacements, system reinforcements, main extensions, new service line installations and service line replacements, and forecast load growth areas…More specifically, the Company will seek opportunities to avoid LPP replacement projects through deployment of thermal energy networks or individual ground or air-source heat pumps. In this effort, the Company will prioritize NPA opportunities that have the highest level of customer interest and/or reflect the lowest level of LPP risk, and it will inform its implementation strategy with lessons learned from similar programs previously undertaken by other utilities” (Order, pg. 98).

- “For gas service requests involving a main extension of more than 100 feet, the Company will conduct an analysis to determine whether the prospective Customers’ needs can be satisfied with an NPA” (Order, pg. 99)

- NPA Heat Pump Monthly Credit: National Grid will provide a monthly bill credit to commercial and residential customers who install a heat pump as part of a NPA project. The credit will last for five years.

- Incentives and Efficiency: to reduce future demand, National Grid will pursue targeted incentives for electrification, demand response and energy efficiency (Order, pg. 99).

- Three Year Lead Time: “To ensure adequate time for customer participation, National Grid’s related outreach will focus specifically on NPAs that might replace traditional reinforcement projects scheduled for implementation at least three years in the future” (Order, pg. 99).

- Customer Outreach: National Grid will be required to provide reliable information about NPAs on its website and in promotional materials, coupled with in-person outreach efforts (e.g. door knocking) as well as email, mail, and phone calls, in addition to other engagement opportunities. These efforts must be tracked and analyzed and included in the annual NPA report.

Within six months of this order (approx. March 2025), National Grid will be required to convene a stakeholder engagement meeting to discuss its progress on this NPA proposal.

In addition to this set of directives for NPAs, the PSC also directed National Grid to launch an Integrated Energy Planning (IEP) pilot “to support targeted customer electrification for NPAs, particularly with respect to nine LPP segments that the Company has identified in the East Gate region that require minimal electric system upgrades to electrify” (Order, pg. 102). By the end of this year, National Grid will be required to start community outreach efforts for the pilot.

Finally, National Grid can no longer market gas as clean and must “cease gas marketing efforts for new gas connections and conversions and encourage applicants seeking new or expanded gas service to consider electrification options” (Order, pg. 104).

Empowering communities, transitioning workers, and achieving our climate goals through clean energy infrastructure

The future of heat represents the “solutions” side of the managed gas transition: the infrastructure, technologies, policies, and programs that we can build up while winding down the gas system. Synchronizing this transition will help achieve a thoughtful, equitable pathway for workers, utilities, ratepayers, and communities.

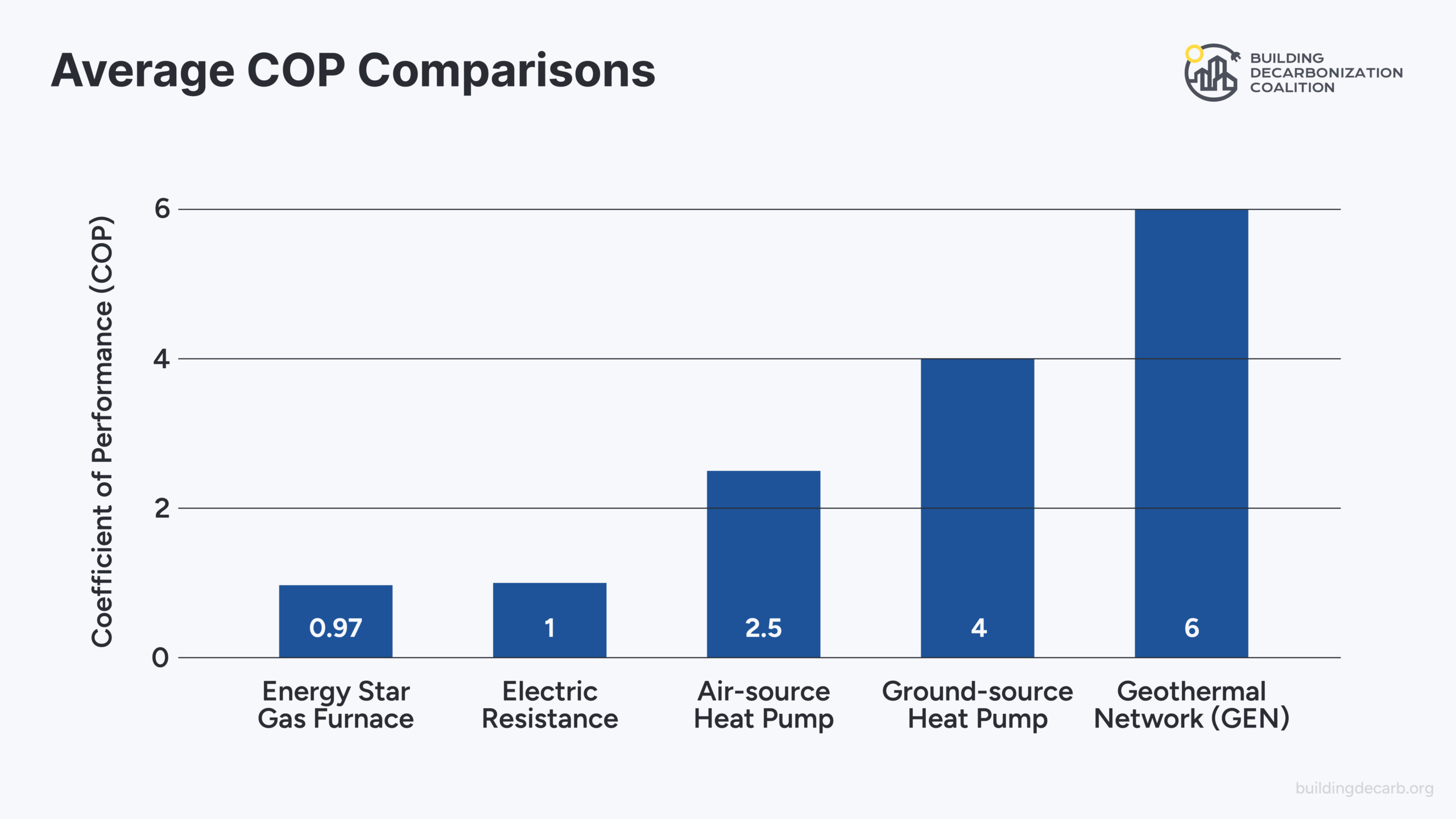

Networked Geothermal is the most efficient arrangement of heat pump technology, and more than six times more efficient than the most efficient gas furnace. The Buro Happold report on thermal energy network lifecycle costs demonstrates the economic feasibility of thermal energy networks in New York State and beyond.

Regulation

Activity in proceedings and standards that are focused on implementing solutions to gas system expansion and emissions.

Q3 Future of Heat Regulatory Highlights:

- Heat Pump Rates: A new seasonal heat pump rate in Massachusetts will save households that use heat pumps an average of $540 this winter

- Non-Pipeline Alternatives: Workshops to explore non-pipeline alternatives for Peoples Gas in Illinois are underway

- Thermal Energy Networks: Lifecycle cost studies for utility-led TENs pilots in NY were filed; a study filed by engineering firm Buro Happold estimates that, compared to air-source heat pumps, TENs could save from $8 million to $75 million in lifecycle costs depending on the size and building types

|

State / Rule or Regulation |

Recent Activity |

Category |

|

California, Rulemaking Regarding Building Decarbonization (R. 19-01-011) |

The Building Decarbonization Rulemaking was opened in 2019 following the passage of SB 1477, which provided funding via the GHG emissions cap-and-invest program for two building electrification pilot programs: the Building Initiative for Low-Emissions Development (BUILD) Program and the Technology and Equipment for Clean Heating (TECH) Initiative. Q3: In June 2025, the CPUC submitted its final decision regarding Phase 4, Track A on new rules regarding electric service line upsizing, modifying electric line extension rules and reporting requirements. The decision included:

|

line extension allowances, rebates and incentives; grid management; workforce |

|

California, OIR to Investigate and Design Clean Energy Financing Options for Electricity and Natural Gas Customers |

Rulemaking 20-08-022 was instituted in 2020 to evaluate the potential efficiencies of offering financing strategies that allow for larger or broader investments in multiple types of clean energy improvements. In 2023, the CPUC directed utilities to propose expanded tariff-on-bill (TOB) financing programs, sometimes called Inclusive Utility Investment (IUI), which essentially allow a ratepayer to incrementally pay the utility back for a new piece of equipment (like a heat pump) via their monthly bill rather than having to advance the entire cost up-front. The mechanism is designed to have the high efficiency of the equipment offset the incremental costs on each monthly utility bill. TOB programs typically seek to make clean energy retrofits more accessible to lower-income households, though the concept of paying for a new appliance through a utility bill charge has been around for more than a century. The Investor-Owned Utilities (IOUs) submitted a joint TOB proposal in 2024, which was evaluated by a third party and released for stakeholder comments in May 2025. Q3:

|

inclusive utility investment, tariff-on-bill, clean energy financing, equity |

|

Colorado, Black Hills Clean Heat Plan (23A-0633G) |

A January 2025 Decision by Colorado’s Public Utility Commission marked the first time a gas-only utility has been directed to help customers electrify their homes and businesses, including pre-electrification weatherization and energy efficiency measures. The decision is the result of the state’s 2021 Clean Heat Plans (SB21-264), a law that directs gas utilities to develop plans to reduce the greenhouse gas emissions. Q3:

|

clean heat standards, electrification |

|

Colorado, Community-Initiated Neighborhood Scale Pilots (25D-0183G) |

Initiated by HB 24-1370, which established a process by which dual-fuel utilities can partner with communities to mutually explore opportunities for neighborhood-scale alternatives energy projects, or non-pipeline alternatives (“NPA”). The Public Service Company of Colorado and the Colorado Energy Office submitted a petition to the Commission seeking approval of neighborhoods selected for participation in the community-initiated Neighborhood-Scale Decarbonization (NSD) pilots.. In June 2025, the Commission decided to move forward with five communities for the NSD pilots: Denver, Boulder, Breckenridge, Winter Park, and Golden will all move forward to the next stage of design. Q3:

|

neighborhood scale, thermal energy networks, electrification |

|

Illinois Informal Process following Docket No. 24-0081, Illinois Commerce Commission

|

The ICC’s final order in Docket No. 24-0081 directed Peoples Gas to work with stakeholders to assess the feasibility of non-pipeline alternatives (NPAs) within its service territory. An independent, third-party facilitator will lead an NPA Workshop process for Peoples Gas. Workshops will be open to all interested stakeholders and must end no later than December 19, 2025. Workshop discussions will inform whether and how NPAs can be integrated into Peoples Gas’ infrastructure planning and leak-prone pipe replacement. Seven workshops are scheduled between Sept. 25th and Dec. 10th, 2025. Workshop Topics:

Q3:

|

non-pipeline alternatives |

|

Maryland, Clean Heat Standard |

Governor Moore’s 2024 Executive Order establishing a Clean Heat Standard (CHS) will require that the thermal sector reduces emissions from heating delivery services and transitions to clean heating services and technologies, including installing zero-emission heating equipment (e.g. heat pumps), weatherizing buildings, and delivering cleaner fuels. A supportive reporting rule (The Heating Fuel Provider Program Rule), which was approved anonymously in June by the Air Quality Control Advisory Council, will move forward for public hearing this quarter. This new rule would require heating fuel providers to report the monthly amount of heating fuel they deliver to Maryland on a county-by-county basis, which allows the Maryland Dept. of Environment to better track health and environmental impacts from fossil fuel combustion. Quarterly reporting under this program would start in 2026 and affect 175 companies

Q3:

|

clean heat standards, electrification |

|

Seasonal Heat Pump Rate Inquiry (D.P.U. 25-08) |

On March, 21, 2025, the Massachusetts Dept. of Public Utilities (DPU) issued an order opening an inquiry into seasonal heat-pump rates following a petition from the Department of Energy Resources (DOER), which, in collaboration with other state agencies, formed an Interagency Rates Working Group (IRWG) to study challenges and opportunities for electric rates. While two major utility companies, Unitil and National Grid, had already implemented newly-approved seasonal heat-pump rates, this proceeding required Eversource Energy to propose a similar rate structure in time for the 2025-26 heating season. The DPU issued an order on July 29, 2025 approving the Eversource proposal, which in turn means that it has now approved seasonal heat pump rates for all residential customers of MA’s electric utilities. Q3:

|

rates, heat pumps |

|

Massachusetts Reforming the Obligation to Serve (D.P.U 25-40 – 25-45)

|

As part of Massachusetts’ Future of Gas proceeding (20-80), the DPU directed gas utilities to work with relevant electric utilities to study the feasibility of piloting neighborhood-scale electrification in their service territories, filing a proposal for a demonstration project by March 1, 2026. However, under the current interpretation of a policy called “obligation to serve,” utilities would need to achieve 100% customer participation to move forward with a neighborhood-scale project that would achieve the cost-savings and emissions reductions goals intended. In the non-pipeline alternative (NPA) framework proposals submitted by utilities in their climate compliance plan dockets (25-40 – 25-45), utilities argued they would need to comply with that customer’s preference and not proceed with a project with even a single holdout customer due to the “obligation to serve” law. To address this issue, the DPU has opened a comment period to clarify the existing law and obligations under this statute, especially in light of the reforms that the 2024 Climate Act made to enable neighborhood-scale decarbonization. In brief, the Climate Act altered the obligation to serve law such that if adequate substitute services were available (e.g. swapping electricity for gas), the department may allow the removal of existing services in order to advance public interest (such as enable a neighborhood-scale decarbonization project). Utilities have argued against this interpretation as it applies to existing services, claiming it applies only to customers who have requested new service extensions and have been denied. Q3:

|

obligation to serve, neighborhood scale |

|

New York, Energy Efficiency and Building Electrification proceedings 14-M-0094: Proceeding on Motion of the Commission to Consider a Clean Energy Fund 18-M-0084: In the Matter of a Comprehensive Energy Efficiency Initiative 25-M-0248: In the Matter of the 2026-2030 non-Low- to Moderate-Income Energy Efficiency and Building Electrification Portfolio 25-M-0249: In the Matter of the 2026-2030 Low- to Moderate-Income Energy Efficiency and Building Electrification Portfolio |

The Energy Efficiency and Building Electrification proceeding formerly referred to as “New Efficiency: New York (NE:NY)” is the $5 billion program of ratepayer funded energy efficiency and electrification incentive programs. These program offerings were under regulatory review by the NYS Public Service Commission with the goal of improving the programs and spending for these programs. On May 15, 2025 the New York Public Service Commission issued established two new proceedings (one specific to Low- and Moderate-Income programs [25-M-0249] and the other for market-rate programs [25-M-0248]) authorizing approximately $1 billion / year over the 2026 – 2030 periods for increased energy efficiency and clean energy solutions, including building electrification. Administered by the state’s large investor-owned electric and gas utilities and the New York State Energy Research and Development Authority (NYSERDA), nearly a third of this program funding ($1.57 billion) will be dedicated exclusively to low and moderate-income (LMI) programs. Q3:

|

energy efficiency, electrification, LMI programs |

|

New York, Utility Thermal Energy Network and Jobs Act (UTENJA) 22-M-0429 |

Since being directed by the 2022 UTENJA law, New York utilities have been exploring how they can use thermal energy networks to decarbonize entire neighborhoods in different communities across the state. There are currently 10 proposed pilot projects being considered by the Public Service Commission (PSC). Q3:

|

thermal energy networks, workforce, neighborhood scale |

Proposed bills that seek to develop, support, and enable clean energy alternatives to the gas system.

For the fourth year running, BDC has analyzed the trends in building decarbonization legislation across the U.S. In that time period, we’ve clocked 456 bills that were filed in 37 states. Of these 456 bills, 164—over a third—became law.

- In the 2025 legislative session, we tracked 130 bills and budget items promoting building decarbonization, 40 of which have passed so far this season (with 15 pending bills in Massachusetts, New Jersey, and Pennsylvania).

- We categorized those 130 bills and budget items into 19 different categories, with regulation, costs & funding, codes, thermal energy networks, energy justice, and resilience seeing the most activity.

- The categories that performed the best were regulation (42% success rate), costs & funding (37%), codes (29%), thermal energy networks (33%), and energy justice (36%).

Read our full analysis of this year and a look back at the past four years here, with key takeaways below and explore details of each of these bills in our public legislation tracker.

Here are some actions we will be watching for in the coming months:

- Market:

- In years past, EnergyStar has released its unit shipment data for the prior year in November. With this update, we’ll see how the heat pump water heater market has continued to grow. However, due to changes in federal priorities, which put the EnergyStar program at risk, we are not yet certain this data will be released.

- On the HVAC side, shipments are slowing down across the board as the market cools. We’ll see if this trend holds and which technologies rebound once the market picks back up.

- Legislation: Planning sessions have commenced in most states while a few with year-round sessions or special veto sessions continue to consider bills, some of which address building decarbonization. We hope to see progress on a few bills on thermal energy networks, resiliency, and energy efficiency in Pennsylvania, New Jersey, Massachusetts and Illinois in the coming months.

- Rates: As of the end of Q3, there were 104 in-progress electric and gas rate cases across 38 states and D.C. that collectively represent over $19.4B in potential rate increases, according to S&P.

- Future of Gas Proceedings: The newest FOG proceeding in Maryland will hit the ground running. Initial testimony from gas distribution companies will be due early in 2026, with discovery, comments, and rebuttals following through the spring.

- Neighborhood Scale: In California, on July 1st, investor-owned utilities submitted maps identifying a total of 5,000 miles of gas pipeline that could be targeted for decommissioning. Priority decarbonization zones for pilots are set to be established by the beginning of 2026, with pilot selections finalized by July 2026. In Colorado, five communities selected for neighborhood-scale decarbonization pilots continue to move forward with partnership agreements with dual-fuel utilities. And in Massachusetts, regulators will soon hear comments to reform a key barrier to neighborhood-scale: the obligation to serve.

- Line Extension Allowance Reforms: We’re hoping for staff proposals on the details of proposed gas line extension allowance reforms in Massachusetts and Maryland by the end of the year; direction of the Minnesota PUC on how they intend to reform their gas LEAs, and a signature from Governor Hochul in New York on their recently passed bill revoking these fossil fuel subsidies.